Archive for October 2022

CHALLENGES IN HIGH COURT TO SMALL BILLS MUST STOP SAYS COURT OF APPEAL

I will be presenting a Zoominar on these cases next Thursday, 3 November 2022 at 4.00 – 5.00pm. £50 plus VAT for as many people as you want. Recording available whether or not you can attend. Please book here.

In two key and very important decisions delivered consecutively by the Court of Appeal today, with the same judges in each case, the Court of Appeal said that the appropriate forum for low value challenges to solicitors bill under the Solicitors Act 1974 was the Legal Services Ombudsman, and not the High Court.

Although the solicitors won in both cases, the Court of Appeal made it clear that if checkmylegalfees.com and others continued to bring “trivial claims” in the High Court, then they would be deprived of their costs, even if they won.

“Firms such as checkmylegalfees.com and their clients should be in no doubt that the courts will have no hesitation in depriving them of their costs under section 70(10) if they continue to bring trivial claims for the assessment of small bills to the High Court, even if those bills are reduced on the facts of the specific case by more than one fifth under section 70(9). The critical issue is and always will be whether it is proportionate to bring this kind of case to the High Court. In this case, it was not.” [Paragraph 45 of Karatysz v SGI Legal [2022] EWCA Civ 1388]

The Court of Appeal took the most unusual step of issuing a press summary in relation to what are two unrelated cases, in that there are no identical parties and nor were the legal issues the same.

The common factor is the attack upon claims like this being brought in the costs-bearing jurisdiction of the High Court.

Here is the Court of Appeal’s summary of the judgments in

Belsner -v- Cam Legal Services [2022] EWCA Civ 1387, 27 October 2022

and

Karatysz v SGI Legal [2022] EWCA Civ 1388

The Court of Appeal states that it will exercise it jurisdiction under 70(10) which allows the court to make such order as respect to the costs of the assessment as it may think fit, if there are “any special circumstances”.

Indeed this opens up the likelihood that not only will the successful client in a Solicitors Act 1974 challenge be deprived of their costs if they wrongly bring the matter in the High Court, but that they may be ordered to pay costs, even though successful.

The importance of these two decisions, and the fact that they were delivered consecutively, and of the joint press summary, and the tone of the language used by the Court of Appeal, can hardly be overstated.

BELSNER

In Belsner -v- Cam Legal Services [2022] EWCA Civ 1387, 27 October 2022

the Court of Appeal allowed the appeal of the solicitors against the deduction from their bill of costs, and gave important rulings on the law governing solicitor and own client retainers, and made highly significant comments concerning the business model of firms such as checkmylegalfees.com challenging solicitors bills in this way, and specifically named that firm who were the solicitors for the Claimant in this matter.

It should be noted that the key legal elements of the decision generally apply only to claims that have not been issued, and are classed as non-contentious.

I will make it clear which parts apply to all claims, and which parts apply only to unissued claims.

This claim was settled at Stage 2 of the Portal process, and thus, substantive Part 7 proceedings were never issued.

The Defendant’s insurer paid damages and fixed costs and disbursements, and the solicitors retained the fixed costs.

The solicitors retained out of damages a success fee of £321.25, being the charges capped at 25% of the recovered damages.

The client then instructed new solicitors trading as Checkmylegalfees.com to query the original solicitors’ bill.

Here, the Court of Appeal said:

“5. The Solicitors in this case were instructed by the Client to bring her claim on the RTA portal. The claim was settled at stage 2 after the provision of medical reports, as is common, with the defendant’s insurer paying damages of £1,916.98 plus fixed costs of £500 plus disbursements (ignoring VAT). The Solicitors retained the fixed costs and paid the Client the damages less a success fee of £321.25 (capped at 25% of the recovered damages – see [28] below). The Client later instructed new solicitors trading as checkmylegalfees.com to query the Solicitors’ charging. The Solicitors point out that the Client did not appeal DJ Bellamy’s assessment that they could reasonably have charged £1,392 (11.6 hours at £120 per hour) for their work (plus a success fee of £208.80), instead of the £321.25 plus £500 fixed costs (£821.25) which they actually asked for and were paid.”

On the first appeal, the High Court allowed the client’s appeal and permitted the solicitors to charge only the fixed costs recovered from the other side and a success fee of £75, which the High Court Judge applied on the basis of a success fee of 15% of fixed costs.

I have commented extensively on the heavily flawed decision of that High Court Judge, and will not repeat that here, although I may analyse matters in more detail in a future piece.

Suffice to say that the Court of Appeal agreed with me on virtually every point I have made in relation to the High Court decision in this case.

The High Court also assumed that the solicitor owed the client a fiduciary duty when the retainer was being negotiated, and that finding was also overturned by the Court of Appeal.

The Court of Appeal also disagreed with the High Court Judge in relation to Section 74(3) of the Solicitors Act 1974 and CPR 46.9(2), or rather whether it had any application to an unissued case.

The Court of Appeal then set out the provisions of the statute and the Civil procedure Rules, which appear in the Judgment, and which I have written about before, and which I do not repeat here.

At paragraph 13 of the Judgment, the Court of Appeal set out the key questions to be determined:

(i) whether section 74(3) and Part 46.9(2) apply at all to claims brought through the RTA portal without county court proceedings actually being issued,

(ii) whether the Solicitors are required to obtain informed consent from the Client in the negotiation and agreement of the CFA, either due to the fiduciary nature of the solicitor-client relationship or through the language of Part 46.9(2),

(iii) if informed consent was required, whether the Client gave informed consent to the terms of the CFA relating to the Solicitors’ fees,

(iv) whether, in any event, what can be regarded as the term in the Solicitors’ retainer allowing the Solicitors to charge the Client more than the costs recoverable from the defendant to the RTA claim was unfair under the Consumer Rights Act 2015, and

(v) what are the consequences of the determination of these issues on the assessment in this case.

The Court of Appeal answered these questions as follows:

(i) section 74(3) and Part 46.9(2) do not apply at all to claims brought through the RTA portal without county court proceedings actually being issued,

(ii) the judge was wrong to say that the Solicitors owed the Client fiduciary duties in the negotiation of their retainer,

(iii) although the Solicitors were not obliged to obtain the Client’s informed consent to the terms of the CFA on the grounds decided by the judge, the Solicitors did not comply with the SRA Code of Conduct for Solicitors (the Code) in that they neither ensured that the Client received the best possible information about the likely overall cost of the case, nor did they ensure that the Client was in a position to make an informed decision about the case,

(iv) the term in the Solicitors’ retainer allowing them to charge the Client more than the costs recoverable from the defendant was not unfair within the meaning of the Consumer Rights Act 2015, and

(v) the court can and should reconsider the assessment on the correct basis, which is under paragraph 3 of the Solicitors’ (Non-Contentious Business) Remuneration Order 2009 (the 2009 Order), which requires the Solicitors’ costs to be “fair and reasonable having regard to all the circumstances of the case”. The costs actually charged to the Client in this case were fair and reasonable.

The finding at (i) apply only to non-issued matters, where court proceedings have not been issued.

Where County Court proceedings have actually been issued, then Section 74(3) and CPR 46.9(2) apply in full.

Given that at the outset solicitors will never know whether or not proceedings will be issued, my practical advice is that in every case, without exception, solicitors should at the outset, comply with Section 74(3) and CPR 46.9(2).

The finding at (ii) applies to all cases of all clients, whether litigation or conveyancing or whatever.

The finding at (iii) is somewhat hybrid in that different rules apply to different situations, and the judgment must be read as a whole.

The finding at (v) applies only to non-issued proceedings, that is non-contentious business.

The Court of Appeal made a number of other comments, and the timing is significant, as well as the content, as there is a holistic review of all Civil Litigation costs and processes, and that is currently being undertaken by the Civil Justice Council.

The Court of Appeal said that:

“…the distinction between contentious and non-contentious costs is outdated and illogical. It is in urgent need of legislative attention.”

“Secondly, there is no logical reason why Section 74(3) and Part 46.9(2) should now apply to cases where proceedings are issued in the County Court and not to cases pursued through the pre-action portals”

“Thirdly, it is unsatisfactory that, in RTA claims pursued through the RTA portal (and perhaps the Whiplash portal), solicitors seem to be signing up their clients to a costs regime that allows them to charge significantly more than the claim is known in advance to be likely to be worth. The unsatisfactory nature of these arrangements is not appropriately alleviated by solicitors deciding, at their own discretion, to charge their clients whatever lesser (and more reasonable) sum they may choose with the benefit of hindsight.”

“Fourthly, it is illogical that, whilst the distinction between contentious and non-contentious business survives, the CPR should make mandatory costs and other (e.g. Part 36 and PD8B) provisions for pre-action online portals, but otherwise deal only with proceedings once issued. Section 24 of the Judicial Review and Courts Act 2022 will allow the new Online Procedure Rules Committee (OPRC), in due course, to make rules that affect claims made in the online pre-action portal space. It would obviously be more coherent for the OPRC to make all the rules for the online pre-action portals …”

The Court of Appeal then made a highly significant comment, and whilst it does not represent the law, and was not a comment on the law, it is a significant and important comment:

“Finally, it is also unsatisfactory that solicitors like checkmylegalfees.com can adopt a business model that allows them to bring expensive High Court litigation to assess modest solicitors’ bills in cases of this kind. The Legal Ombudsman scheme would be a cheaper and more effective method of querying solicitors’ bills in these circumstances, but the whole court process of assessment of solicitors’ bills in contentious and noncontentious business requires careful review and significant reform.” [Paragraph 15 of the judgment]

I still find the decision somewhat confusing in the sense that the Court of Appeal appears to have looked at the whole sum that had charged by the solicitors to the client, and then deducted the success fee, with the rest representing part of the unrecovered solicitor and own client costs.

The correct way is to apply any charge made to the client to the unrecovered solicitor and own client costs element first, and only then, if there is any further charge to be made, to incur into success fee territory.

This is not a mere academic point, as the success fee is capped at a percentage of the Allowed Damages Pool, whereas the unrecovered solicitor and own client element is not.

I have not seen the actual bills in this case, and have not seen the way that they were structured, and it may be that the solicitors erroneously delivered a success fee bill to the client, when in fact everything could have been absorbed by the unrecovered solicitor and own client element.

It makes little difference to the rationale of this decision.

I set above that the finding at (iii) was something of a hybrid finding, and I now set out the Court of Appeal’s explanation of the first appeal Judge’s consideration of this aspect, which appears at paragraphs 40-43 of the judgment.

“40. The judge proceeded on the assumed basis that section 74(3) applied to RTA portal cases, noting at [42] that it was not disputed that the section applied except insofar as Part 46.9(2) might otherwise provide. A major issue before him was whether the phrase “expressly permits” in Part 46.9(2) meant that a client’s informed consent was required in order to disapply section 74(3).”

“41. The judge said at [34] that “[t]he relationship between solicitor and client is a fiduciary one. As a fiduciary, a solicitor may not receive a profit from his client without his client’s fully informed consent”. At [68], he said this I do not consider that this appeal can be determined by a simple comparison between the wording of [Part 46.9(2) and (3)]. The requirement for informed consent which applies in cases under [Part 46.9(3)] does not arise because of the use of the word “approval” rather than the word “agreement”. The requirement for informed consent arises because of the fiduciary nature of the relationship.”

“42. He then held at [69] that when interpreting Part 46.9(2): It goes without saying that an agreement for the purposes of [Part 46.9(2)] must be a valid and enforceable agreement. It follows, for example, that an agreement procured by fraud or misrepresentation would not suffice. Nor, obviously, would an agreement whose performance would involve a breach of fiduciary duty. To that extent, therefore, [Part 46.9(2)] requires informed consent.”

“43. On the basis that Part 46.9(2) required informed consent, he found that the Client had not provided informed consent to pay fees in excess of those recoverable from her opponent. Section 74(3) applied and the Solicitors were limited to charging fixed costs of £500 plus VAT in addition to the (reduced) success fee.”

Issue 1: Do section 74(3) and Part 46.9(2) apply to claims brought through the RTA portal without county court proceedings actually being issued?

The Court of Appeal deals with this issue at length at paragraphs 45 – 61 of the judgment and I have set out the conclusion above.

However, it is worth setting out the Court of Appeal’s definition of contentious business taken from the decision in

re Simpkin Marshall Ltd [1959] Ch 229 (Simpkin Marshall)

“There is now a clear and, I should have thought, logical division between contentious and non-contentious business. All business is now to be regarded as contentious which is done before proceedings are begun provided that the business is done with a view to the proceedings being begun, and they are in fact begun, and also all business done in the course of the proceedings. All other business is non-contentious.”

The Court of Appeal said that while it is true that the RTA Portal is an official process introduced by the Ministry of Justice, that does not make claims within it into proceedings in the County Court.

The fact that rules of court make various provisions for cases brought within the RTA Portal may be illogical, but it does not convert Portal claims into County Court claims. [Paragraph 58]

Civil Procedure Rules, specifically CPR 46.9(2) cannot enlarge the meaning of Section 74(3), “however convenient that might be”. [Paragraph 59]

In the context of the forthcoming reforms, the Court of Appeal made a significant comment at paragraph 61:

“61. These conclusions do not mean that the distinction between contentious and noncontentious costs is a meaningful or logical one now that the pre-action online portals form a significant part of the litigation environment. I have no doubt that the 1974 Act is in urgent need of legislative attention. Moreover, these conclusions do not mean that it is logical for section 74(3) and Part 46.9(2) to apply to cases where proceedings are issued in the County Court and not to cases pursued through pre-action portals.”

Issue 2: Were the Solicitors required to obtain informed consent from the Client in the negotiation and agreement of the CFA, either due to the fiduciary nature of the solicitor-client relationship or through the language of CPR 46.9(2)?

This is discussed at length by the Court of Appeal at paragraphs 62 – 81 of the judgment.

As it clear from the finding on Issue 1, the Court of Appeal had found neither Section 74(3) nor CPR 46.9(2) applied here, as it was non-contentious business.

Although CPR 46.9(2) does not apply, CPR 46.9(3) does, and that applies to the assessment of costs in both contentious and non-contentious business.

The Court of Appeal held that the High Court Judge was wrong to think that the client’s informed consent was required in this case because of the wording of CPR 46.9(2) as that “is and was irrelevant to the formation of the CFA in this case”.

The Court of Appeal went on to make the entirely valid point concerning the problem of not knowing at the outset, when a CFA is entered into, as to whether the matter will be issued or not.

“70. This conclusion may seem strange because, in theory, section 74(3) and Part 46.9(2) could have applied to this CFA, had county court proceedings been issued. It might have been said that, since the parties could not have known when they entered into the CFA whether, in future, proceedings would be issued, the conclusion is illogical. That, in my view, is just one unsatisfactory consequence of the fact that the current legislation takes no proper account of the fact that many claims are pursued in online pre-action portals without proceedings being issued. It cannot mean that statutory provisions applicable only to contentious business can be applied to non-contentious business.”

The Court of Appeal also recognized that the fact that CPR 46.9(2) did not apply “does not answer the question of whether the Solicitors owed the Client a duty to seek her fully informed consent to the level of their fees”. [Paragraph 71]

Did the fiduciary nature of the solicitor/client relationship or the solicitors’ duty of care give rise to a fiduciary duty to obtain the client’s fully informed consent?

This is dealt with at paragraphs 72 – 81 of the judgment, but the short answer is no.

However, the moment that solicitors start acting for a client there is a fiduciary duty, but only in relation to the steps that the solicitors take in relation to the case, and not in relation to the retainer.

In other words, if a case starts before the Conditional Fee Agreement is entered into, that does not create a fiduciary duty in relation to that retainer.

“80. The duty to ensure that clients receive the best possible information about pricing and the likely overall cost of the case may have similarities to fiduciary duties of loyalty, but they are not such duties. They are professional duties, and the consequences of the breach of a professional duty, even one given effect by statute, are different from the consequences of breaches of fiduciary duties.”

Issue 3: Did the Client give her informed consent to the terms of the CFA relating to the Solicitors’ fees?

This dealt with at paragraphs 82 – 86 of the judgment, and the Court of Appeal had already found that it did not think, as a matter of law, that the solicitors were obliged to obtain the client’s informed consent at the terms of the Conditional Fee Agreement, on the grounds decided by the High Court Judg.

However, the Court of Appeal said that it was appropriate to explain what the solicitors should have done in order to comply with their professional duties.

In this case, the solicitors neither ensured that the client received the best possible information about the likely overall costs of the case, as required by paragraph 8.7 of the Solicitors Code of Conduct, and nor did they ensure that the client was in a position to make an informed decision about whether she needed the service they were offering on the terms that they were suggesting as required by paragraph 8.6.

“84. In this case, the Client was given most of the information she needed to make those decisions, with the exception of one vital matter, namely the fixed recoverable costs that the defendant’s insurers would pay within the RTA portal. It would have been straightforward for the Solicitors to inform the Client of the level of the fixed recoverable costs that could be recovered at stages 1 and 2. The Client was told that the Solicitors estimated their base costs at £2,500 (net of VAT and disbursements), and that many such claims would settle within the RTA portal after production of medical evidence and financial losses. She was also given an estimate of £2,000 for her damages. Had she also been told of the level of the fixed recoverable costs, she would have been able to compare the likely recoverable costs with the amount she was being asked to agree to pay the Solicitors. As the Client submitted to us, she would then have known that she was assuming a liability to pay the Solicitors five times the costs she would be getting back from the defendant. I do not think that the Solicitors can be said to have complied with either [8.7] or [8.6] of the Code without providing that information.”

“86. In my judgment, it is wholly unsatisfactory for solicitors generally, and these Solicitors in particular, routinely to suggest that their clients agree to a costs regime that allows them to charge significantly more than the claim is known in advance to be likely to be worth. Solicitors do not resolve this unsatisfactory state of affairs by allowing a discretionary reduction of their charges after the case is settled. It would, in theory, be possible for there to be an order made under section 56 of the 1974 Act to deal with this problem, and perhaps some of the others I have identified in relation to current practice, by the establishment of reformed general principles applicable to the determination of the proper remuneration of solicitors in respect of non-contentious business within the pre-action online portals.”

Issue 4: Was the term in the Solicitors’ retainer allowing the Solicitors to charge the Client more than the costs recoverable from the defendant to the RTA claim unfair under the Consumer Rights Act 2015?

This is dealt with at paragraphs 87 – 92 of the judgment.

Section 62(4) of the Consumer Rights Act 2015 makes a term of a consumer contract unfair, and therefore, not binding on the consumer, if “contrary to the requirement of good faith, it causes a significant imbalance in the parties’ rights and obligations under the contract to the detriment of the consumer”.

The Court of Appeal set out the way the client put its case.

The term as to recovery of costs over and above fixed costs creates a significant imbalance to the client’s detriment, because it results in:

(a) a liability for base costs of a sum greatly in excess of the fixed maximum that would be allowed pursuant to s.74(3) Solicitors Act 1974, and

(b) consequent use of such base costs figure as the multiplicand in calculation of the success fee, in both cases without mentioning either

(i) the fact of the statutory protection provided by s.74(3) or its purported disapplication,

(ii) (how that statutory protection would have operated and how its disapplication is to the detriment of the client, or

(iii) the likely maximum in this particular case.

Thus, the client submitted that the term in her retainer as to recovery of costs over and above fixed costs created a significant imbalance to the client’s detriment, and was therefore, unfair.

The client put the case on the basis that the term was unfair because it results in the liability for base costs much in excess of “the fixed maximum that will be allowed pursuant to section 74(3)”.

As Section 74(3) did not apply in this case, a claim under the Consumer Rights Act 2015 also failed.

That does not mean, that had the client’s case been pleaded differently, such a claim would have failed.

Solicitors still need to ensure that they do not fall foul of Section 62(4).

Issue 5: The consequences of these determinations on the assessment in this case

The Court of Appeal proceeded to assess the costs on the basis of whether they were fair and reasonable under paragraph 3 of the Solicitors’ (Non-Contentious Business) Remuneration Order 2009.

It was.

The test was set out in paragraph 96:

“The ultimate question on an assessment of non-contentious costs, taking into account the factors stated in the 2009 Order, is: what overall amount would it be fair and reasonable for the client to pay? As Morgan J said in Mastercigars v. Withers [2009] 1 WLR 881 at [102]:

Even if the solicitor has spent a reasonable time on reasonable items of work and the charging rate is reasonable, the resulting figure may exceed what it is reasonable in all the circumstances to expect the client to pay and, to the extent that the figure does exceed what is reasonable to expect the client to pay, the excess is not recoverable.”

While the client ought, as a matter of good professional practice, to have been told the level of fixed costs that would be recovered from the other side if the matter settled within the Portal, that did not necessarily make the bill unfair, and here it was not unfair.

There is no legal duty on a solicitor to obtain fully informed consent to charge more by way of base costs that was recovered from the third party.

Perhaps the most important paragraph is one that does not deal with the law at all:

“98. The Client in this case has never had any real or economic interest in the pursuit of this costly litigation. Only checkmylegalfees.com have such an interest. The Solicitors capped their fees voluntarily at a fair and reasonable level after the event, even if they ought to have told the Client what she would recover by way of fixed costs in the RTA portal, and even if they ought to have agreed in advance when they entered into the CFA to the cap they later applied voluntarily.”

As to the law, the Court of Appeal restated what has been the law for a long time, namely that the issue under Section 70(9) of the Solicitors Act 1974 is as to what sum the solicitor is demanding, and not what the original contractual liability may have been.

Here the client achieved no reduction from the sum that the solicitor ended up asking for, and therefore, the starting position is that the client must pay the full costs of her application, and the two appeals to the High Court and the Court of Appeal, unless there are special circumstances under Section 70(10) of the Solicitors Act 1974.

The Court gave full reasons for that statement of the law, in the case it heard, with the same Judges, immediately after the Belsner case.

That case is Karatysz v SGI Legal [2022] EWCA Civ 1388.

KARATYSZ

In Karatysz v SGI Legal [2022] EWCA Civ 1388

the issue was the amount of the solicitors’ statute bill, the relevance being that Section 70(9) of the Solicitors Act 1974 provides that the costs of assessment are paid by the solicitors if the amount of the bill is reduced by one fifth, but otherwise by the client.

The District Judge had determined that the bill was £2,731.90 but the High Court on appeal had held it to be £1,571.50.

If the District Judge was right, then the solicitors would have to pay all of the costs of the first hearing, the appeal to the High Court, and this appeal to the Court of Appeal; if the High Court was right, then the client would have to pay all of those costs.

Here, the Court of Appeal held that the High Court Judge was right, and therefore, the client had to pay all of the costs.

However, the Court of Appeal said that it intended in the judgment to make clear how solicitors should frame their statute bills in future, so as to avoid future costly disputes of this kind.

The Court of Appeal said that in Belsner, it had already stated that:

(i) it is unsatisfactory that solicitors like checkmylegalfees.com can adopt a business model that allows them to bring expensive High Court litigation to assess modest solicitors’ bills in cases of this kind, and that

(ii) the Legal Ombudsman scheme would be a cheaper and more effective method of querying solicitors’ bills in these circumstances.

Essentially, here, the Claimant client was bringing into play all of the original bill as compared with the sum which the solicitors actually sought from the client at the end of the day.

I have written on this principle elsewhere and I will do so again, but the main purpose of this write up is the significance of the comments in relation to bringing these claims in the High Court.

In simple terms, the amount of the bill is the amount demanded, and not the amount that the solicitor claims he had the right to charge.

Part of the argument here, which I will deal with on another occasion, was that as the success fee is limited by reference to the full solicitor and own client costs, those costs must be established, and therefore, it must be those full costs which form the basis on which the court decides whether or not the client has achieved a 20% deduction.

The Court of Appeal made the following helpful comment:

“35. In reality, the proper question might be more clearly phrased, in respect of the category or categories of costs being assessed, as “what is the total sum that the bill is demanding be paid to the Solicitors, whether or not all or part of that total sum has actually been paid?”. It matters not whether the costs charged in the bill have been paid or not, so long as that fact is made clear on the face of the bill. I also do not think that it matters that the costs stated have been paid in whole or in part by a third party, whether insurer or not, again so long as that fact is clearly stated on the face of the bill.”

The Court of Appeal then had this to say about the fact that this and similar matters are being brought in the High Court:

“45. The Client allowed checkmylegalfees.com to bring this costly case on her behalf, when she had almost nothing to gain. As Lavender J demonstrated at [42], she recovered £177.50 before DJ Bellamy, which was all that was really at issue except massive sums by way of costs. The process whereby small bills of costs are taxed in the High Court is to be discouraged. It is far more economic to use the Legal Ombudsman scheme which is a cheaper and more effective method of querying solicitors’ bills in these circumstances. Moreover, whilst it has not been necessary to decide whether there were “special circumstances” in this case under section 70(10), because the Client has not succeeded on her appeal, there remains a lesson to be learned from this case. Firms such as checkmylegalfees.com and their clients should be in no doubt that the courts will have no hesitation in depriving them of their costs under section 70(10) if they continue to bring trivial claims for the assessment of small bills to the High Court, even if those bills are reduced on the facts of the specific case by more than one fifth under section 70(9). The critical issue is and always will be whether it is proportionate to bring this kind of case to the High Court. In this case, it was not.”

The Court of Appeal then went on to give guidance as to how statute bills, or what it said should from now on be referred to as statutory bills be drawn.

Properly drawn bills ought in future to state the agreed charges and/or the amounts that the solicitors are intending by the bill to charge, together with their disbursements.

They should make clear what parts of those charges are claimed by way of

(i) base costs;

(ii) success fee (if any), and

(iii) disbursements.

The bill ought also to state clearly:

(i) what sums have been paid, by whom, when and in what way (i.e. by direct payment or by deduction),

(ii) what sum the solicitor claims to be outstanding, and

(iii) what sum the solicitor is demanding that the client (or a third party) is required to pay.

Comment

These decisions are of enormous practical importance for solicitors, and are extremely welcome and will be applauded by probably all but two law firms in the country.

I will be presenting a Zoominar on these cases next Thursday, 3 November 2022 at 4.00 – 5.00pm. £50 plus VAT for as many people as you want. Recording available whether or not you can attend. Please book here.

CIVIL JUSTICE COUNCIL COSTS WORKING GROUP CONSULTATION PAPER – JUNE 2022 – DEADLINE 12 NOON TODAY

Part 4 – Consequences of the extension of Fixed Recoverable Costs

Here is my response.

RESPONSE TO CIVIL JUSTICE COUNCIL COSTS WORKING GROUP CONSULTATION PAPER – JUNE 2022

Part 4 – Consequences of the extension of Fixed Recoverable Costs

4.1 To the extent you have not already commented on this point, what impact do the changes to fixed recoverable costs have on the issues raised in parts 1 to 3 above?

Costs budgeting is not required, obviously, in cases subject to Fixed Recoverable Costs, and Guideline Hourly Rates have no application in relation to such cases either.

The existing Fixed Recoverable Costs scheme, and the very substantial extension in April 2023 both deal with pre-issue costs.

Consequently, Fixed Recoverable Costs eliminate the need to consider any of the issues raised in Parts 1-3 above, which is a very significant benefit of Fixed Recoverable Costs.

Fixed Recoverable Costs should be extended to all civil litigation without exception.

4.2 Are there any other costs issues arising from the extension of fixed recoverable costs, including any other areas in which some form of fixed costs or cost capping scheme may be worthy of consideration? If so, please give details.

As stated above, Fixed Recoverable Costs should be extended to all areas of civil litigation.

Fixed costs are preferable to capped costs, in that capped costs still create uncertainty, and allow scope for argument about the level of costs within the cap, and still leaves open the possibility of assessment of costs, and the attendant delay and expense.

4.3 Should an extended form of costs capping arrangement be introduced for particular specialist areas (such as patent cases or the Shorter Trials Scheme more generally)? If so, please give details.

As stated above, fixed costs are preferable to capped costs, but capped costs are better than no costs control at all.

One obvious area, currently heavily abused, is Solicitors Act 1974 challenges, where there are open, generally indemnity costs, even on the most trivial of claims.

Fixed costs should be introduced here as a matter of urgency, and generally I see no reason why Part 8 applications should be excluded from the Fixed Costs Regime.

CIVIL JUSTICE COUNCIL COSTS WORKING GROUP CONSULTATION PAPER – JUNE 2022 – DEADLINE 12 NOON TODAY

Part 3 – Costs Under Pre-Action Protocols/Portals and The Digital Justice System

Here is my response.

RESPONSE TO CIVIL JUSTICE COUNCIL COSTS WORKING GROUP CONSULTATION PAPER – JUNE 2022

Part 3 – Costs Under Pre-Action Protocols/Portals and The Digital Justice System

3.1 What are the implications for costs associated with civil justice of the digitisation of dispute resolution?

Digitisation always leads to an increase in costs, as effectively the work has to be done twice, that is taking the information and then uploading it.

There are also significant extra costs in terms of maintaining the relevant software etc.

3.2 What is the impact on costs of pre-action protocols and portals?

3.3 Is there a need to reform the processes of assessing costs when a claim settles before issue, including both solicitor own client costs, and party and party costs?

3.4 What purpose(s) does the current distinction between contentious business and non-contentious business serve? Should it be retained?

I can deal with these together.

A key issue concerns assessing costs before court proceedings begin, and a recognition that in an age of portals, protocols and digital justice, whatever that means, there is not such an obvious point where the Rubicon is crossed, and proceedings are issued.

For example, in the existing portal system for personal injury work, do proceedings begin when:

i. The Claim Notification Form is lodged on the portal; or

ii. when Stage 3 is engaged, and a court fee paid; or

iii. only when the matter drops out of the process and substantive Part 7 proceedings are issued?

Pre-issue work is non-contentious, but becomes retrospectively contentious once proceedings are issued, which is why in a matter settled pre-issue there needs to be a contractual provision for costs, e.g.:

“The defendant will pay the claimant’s reasonable costs to be assessed if not agreed.”

What is, or is not, contentious, or a dispute, was considered recently by the Supreme Court in

Bott & Co Solicitors Ltd v Ryanair DAC [2022] UKSC 8 (16 March 2022)

and remains to be ruled upon by the Court of Appeal in the seemingly endless saga of

Belsner v Cam Legal Services Ltd [2020] EWHC 2755 (QB)

In the absence of an entitlement to costs pre-issue, there is an incentive to issue, which goes against current Government and Judicial thinking, partly, or even mainly, because of the shortage of judges and resources.

That is a different issue from the desirability of certainty in relation to costs where matters are resolved through a quasi-Judicial pre-issue portal process.

Both the existing personal injury pre-action process, and the general civil litigation fixed recoverable costs scheme from April 2023, provide an entitlement to fixed costs where the matter is settled pre-issue.

However, there is a fundamental difference between personal injury work and other civil litigation, in that Qualified One-Way Costs Shifting means that an unsuccessful personal injury claimant generally does not pay the successful defendant’s costs.

In general civil litigation they do. Creating that liability pre-issue means that a putative claimant who does not go ahead with the claim is liable for the un-sued defendant’s costs.

Let us take an example.

It is April 2023. Charlie Claimant writes the email from hell to Denise Defendant claiming £100,000 and saying that it is a Band 4 case with maximum fixed recoverable costs.

Denise Defendant politely tells Charlie Claimant to go away and no further action is taken.

Under the new system the putative claimant has to pay the un-sued defendant £16,000 (see page 106 of Lord Justice Jackson’s Supplemental Report: Fixed Recoverable Costs).

That will come as a shock to some of the more aggressive litigators and their clients, and it throws up many issues.

When does liability crystalize?

In issued proceedings it would be on defeat, or on Notice of Discontinuance. Is there to be a form of pre-action strike out, so that if no action is taken for three months or whatever, then the inactive claimant becomes liable for costs?

Can a claimant keep it jogging along – at no extra costs as they are fixed – for the six-year limitation period?

What about a Litigant in Person who writes an email with it never occurring to them that they are thus engaging in a cost bearing litigation process?

Where does the system draw a line between, at one end, a mild Letter of Complaint, and at the other a full-blown Letter before Action?

The risk is that a digital process will be seen as a form of litigation and have the consequences of deterring parties from engaging and thus have exactly the opposite of the intended effect.

Small businesses in particular are concerned about this.

At the Civil Justice Council meeting there was a general view that there should be pre-issue costs liability, but no consensus on where to draw the line.

Whatever happens, it is hard now to justify the distinction between contentious and non-contentious business, and surely it is time that these terms were scrapped.

Likewise, the indemnity principle, which in any event has no application in fixed recoverable costs cases – see

Butt v Nizami [2006] EWHC 159 (QB)

The related matters of costs under pre-action protocols and portals and the digital justice system on the one hand, and fixed recoverable costs for pre-issue work whether the matter becomes issued or not, are of great importance if the desire is to have matters settled pre-issue.

At present there are more questions than answers.

CIVIL JUSTICE COUNCIL COSTS WORKING GROUP CONSULTATION PAPER – JUNE 2022 – DEADLINE 12 NOON TODAY

Costs Budgeting

Here is my response.

RESPONSE TO CIVIL JUSTICE COUNCIL COSTS WORKING GROUP CONSULTATION PAPER – JUNE 2022

Part 1 – Costs Budgeting

1.1 Is costs budgeting useful?

Costs budgeting has some use, and it does act as a discipline on parties, and lessens the need for detailed assessment.

However, it achieves nothing that could not be achieved much more effectively by the extension of Fixed Recoverable Costs to all civil work.

1.2 What if any changes should be made to the existing costs budgeting regime?

It should be extended to civil claims above £10 million. Excluding such cases makes no sense at all; it is the equivalent of having a full budget for constructing a shed, but no budget at all for building a house.

The extension of Fixed Recoverable Costs in April 2023 to virtually all Civil claims valued at £100,000 or less will dramatically reduce the number of cases where budgeting applies.

Lord Justice Jackson’s original proposal, in his speech before his Report was published, was that Fixed Recoverable Costs should be extended to virtually all civil claims valued at £250,000 or less, and in the Business and Property Courts claims up to that value will be subject to a costs capping pilot.

I would scrap now costs budgeting on all cases valued at £250,000 or less on the basis that the Fixed Recoverable Costs regime up to £100,000 gives the court sufficient guidance in relation to claims up to £250,000.

In other words the Fixed Recoverable Costs figures, meticulously worked out, can act as a guide for parties and the courts in claims up to £250,000.

This also deals with the issue of incurred costs, in the sense that the Fixed Recoverable Costs scheme covers all stages, including pre-issue, and therefore, is much more valuable than a court budgeting the matter halfway through.

This would obviously greatly reduce the pressure on the courts, and the time and costs to lawyers and their clients.

The time and costs of budgeting is disproportionate in lower-value cases, as it does not take significantly less time to prepare a costs budget for a claim worth £200,000, as compared with one worth, say, £1 million.

This change can be progressive, in that if Fixed Recoverable Costs are extended to claims up to £250,000, which is expected to happen in due course, then costs budgeting could be scrapped for any claim valued at £500,000 or less.

1.3 Should costs budgeting be abandoned?

Not at the moment, but we should work toward its elimination by the spread of Fixed Recoverable Costs to all civil litigation in due course.

1.4 If costs budgeting is retained, should it be on a “default on” or “default off” basis?

It should be on default-off basis, that is the parties and the court would need to show justification for costs budgeting in any given case.

1.5 For cases that continue within the costs budgeting regime, are there any high-level changes to the procedural requirements or general approach that should be made?

I believe that I have dealt with these points above.

There is a central flaw in the concept of budgeting, in the sense that it is a budget to be paid by someone else.

Consequently, there is a perverse incentive to make the budget as high as possible, so in a sense it becomes the reverse of a budget.

EXTENDING FIXED RECOVERABLE COSTS: TODAY’S ZOOMINAR AT 4.00 PM

Book here.

Today’s Zoominar will be discussing the whole issue of the extension of fixed recoverable costs to virtually all civil litigation valued at £100,000 or less, with effect from 3 April 2023.

Below is my Newsletter Special on this subject, and these are the topics we will discuss in the Zoominar.

EXTENDING FIXED RECOVERABLE COSTS SPECIAL

The three reports need to be read together and are here:

Review of Civil Litigation Costs: Supplemental Report Fixed Recoverable Costs

Extending Fixed Recoverable Costs in Civil Cases: Implementing Sir Rupert Jackson’s Proposals Extending

Fixed Recoverable Costs in Civil Cases: The Government Response

Introduction

The introduction of fixed recoverable costs in relation to nearly all civil litigation claims valued at £100,000 or less represents the biggest change for civil litigators since the implementation of the Woolf Report, and the consequent introduction of the Civil Procedure Rules over 20 years ago.

These reforms relate primarily to civil litigation, but much personal injury work is caught by them.

In relation to costs, it is arguably the most significant change since lawyers were first allowed to charge for court work, that is since the Attorneys and County Court Act 1235, which I wrote about in Issue 42 at pages 123-124 – ATTORNEYS AND COUNTY COURT ACT 1235

So that is arguably the biggest change in costs for 787 years.

Ironically, given that fixed recoverable costs have to date been the preserve of personal injury cases and lawyers, virtually all of the exceptions from the new scheme running up to £100,000 are in the field of personal injury, and as far as general civil litigators are concerned, the only exceptions are:

- Professional negligence;

- Intellectual property; and

- Judicial Review

- Part 8 Claims

- Solicitors Act 1974 challenges

Even intellectual property and professional negligence claims are brought into the Fixed Recoverable Costs Scheme if valued at £25,000 or less, and so the only fully exempt matters are Judicial Review, Part 8 claims and Solicitors Act 1974 challenges.

Make no mistake, for civil litigators this will change forever the way you work and think.

Lawyers have been described as terrible at anticipating change, but brilliant at adapting to it.

We will see.

Case Law

The extensive case law on fixed recoverable costs is likely to be applied to the new system.

Summary

The starting point is that there will be a new fast track limit of £100,000 for all civil claims, and that all claims in that fast track will be subject to fixed recoverable costs, unless specifically excluded.

Even the excluded categories will be subject to fixed recoverable costs if the claim is valued at £25,000 or less. So all civil litigation of all kinds valued at up to £25,000 will be subject to Fixed Recoverable Costs, with the exceptions of Part 8 claims, Judicial Review work and Solicitors Act 1974 challenges.

Lord Justice Jackson proposed a new intermediate track for claims valued at between £25,000 and £100,000, but the Government has chosen not to implement that, but rather to expand the fast track to include all sub £100,000 claims, but with fast fast track claims under £25,000 and intermediate fast track claims for the £25,000 to £100,000 bracket.

The current plan is that the new scheme come into effect this October – see November 2021 Civil Procedure Committee meeting minutes.

Lord Justice Jackson’s original intention was that the limit be £250,000, but he was persuaded to reduce that to £100,000, due to the apparent success of costs budgeting, but in the five years since his supplemental report, budgeting is regarded less favourably than it was, and the whole concept is now being reviewed.

There is a wholesale review of civil costs generally, conditioned by the Master of the Rolls, and this review includes considering whether costs budgeting should be modified, or even scrapped.

It would come as no surprise to me at all if, in say 2025 fixed recoverable costs were extended to claims up to £250,000, with the consequent reduction in cases that need to be budgeted.

Significantly the Business and Property Courts capped costs pilot covered claims up to £250,000.

Background

In his 2016 book – The Reform Of Civil Litigation – Lord Justice Jackson wrote

Kerry Underwood’s prediction. In 2006, Kerry Underwood published the second edition of his book Fixed Costs. Chapter 1 began with a bold statement: “Fixed costs represents an opportunity to rescue a civil justice system that, like most public services, is in terrible trouble.” Chapter 1 predicted that fixed costs would spread quickly from the RTA scheme to other areas of litigation.

What was the position in 2009, when the costs Review began? The position was essentially the same as described in Underwood’s book.

After some phone calls and emails, I became involved in this Review, resulting in the publication on 31 July 2017 of Lord Justice Jackson’s Supplemental Report

Review of Civil Litigation Costs: Supplemental Report Fixed Recoverable Costs

On 28 March 2019, the Ministry of Justice published its consultation paper:

Extending Fixed Recoverable Costs in Civil Cases: Implementing Sir Rupert Jackson’s Proposals

That consultation paper contained the Government’s proposals for implementing the reforms and needs to be read in conjunction with the final document, published on 6 September 2021 by the Ministry of Justice:

Extending Fixed Recoverable Costs in Civil Cases: The Government Response

On 10 December 2021, the minutes of the November 2021 Civil Procedure Committee meeting were published, giving the implementation date as October 2022, with this to be achieved by a complete re-draft of CPR 45 “to simplify and streamline the rules”

A policy decision has been made to implement these reforms ahead of the review of civil costs put in place by the Master of the Rolls on 25 November 2021, which will look at:

- Costs shifting – should costs follow the event?

- Budgeting – should it be modified or even scrapped?

- Guideline Hourly Rates with specific reference to location – should it matter?

Exclusions and Variations

There are four different treatments of civil cases in the new regime.

1. Those excluded all together;

i. Part 8 claims;

ii. Judicial Review cases

iii. Solicitors Act 1974 Challenges

2. Those included, but only up to £25,000;

i. mesothelioma / asbestos

ii. professional negligence

iii. actions against the police

iv. child sexual abuse

v. intellectual property

vi. complex personal injury

Claims in these categories valued more than £25,000 will not be covered by fixed recoverable costs.

3. Those included up to £25,000 but with their own bespoke system;

i. clinical negligence

ii. noise induced hearing loss

iii. package holiday sickness claims

4. The rest, up to £100,000, are be covered by two different matrices

i. Sub £25,000 matrix of RTA;

ii. £25,000 to £100,000 matrix

Allocation to Track

For all intents and purposes, in spite of the decision not to adopt Lord Justice Jackson’s proposal of an intermediate track, there will be four tracks.

i. The Small Claims Track;

ii. Fast Fast Track;

iii. Intermediate Fast Track

iv. Multi-Track

As now, any case allocated to the multi-track will escape fixed recoverable costs.

The Escape Clause

The Escape Clause, currently in CPR 45.29 J will remain.

45.29J

(1) If it considers that there are exceptional circumstances making it appropriate to do so, the court will consider a claim for an amount of costs (excluding disbursements) which is greater than the fixed recoverable costs referred to in rules 45.29B to 45.29H.

(2) If the court considers such a claim to be appropriate, it may—

(a) summarily assess the costs; or

(b) make an order for the costs to be subject to detailed assessment.

(3) If the court does not consider the claim to be appropriate, it will make an order—

(a) if the claim is made by the claimant, for the fixed recoverable costs; or

(b) if the claim is made by the defendant, for a sum which has regard to, but which does not exceed the fixed recoverable costs,

and any permitted disbursements only

Budgeting

There will be no costs budgets in fixed recoverable costs cases.

Qualified One-Way Costs Shifting

This will remain.

Multiple Claims

25% for each additional claimant in all cases, as compared with the current position where it is just for Package Holiday Sickness Claims.

Part 8 Claims

Part 8 claims will not be included until the new reforms have had time to bed in.

Court Fees

The existing multi-track court fees will apply to intermediate cases.

London Weighting

12.5% uplift to remain, but note the current review of civil costs, which questions whether location should have any relevance.

Indemnity Costs

(i) Part 36

Rather than detailed assessment of indemnity costs, there will be a 35% uplift on fixed costs in relation to the stages from the time of the Part 36 offer.

This is specifically stated to avoid the need for detailed assessment “and the keeping of records to inform an assessment.”(my bold)

(ii) Unreasonable Litigation Conduct

There will be a percentage up lift on fixed recoverable costs of 50% where the court find that there has been unreasonable behaviour during litigation.

Bye bye time recording, work in progress and case management systems.

I deal with these matters in more detail below.

Interim Applications and Preliminary Issues

These will be dealt with differently, depending on which track and Band the matter is in, and I deal with this in more detail below.

Inflation and Uprating

This is a major cause for concern.

In his July 2017 Report, Lord Justice Jackson uprated the sub £25,000 claim figures by 4% to take account of inflation between 1 April 2013 and 13 July 2017.

Five years on, the Government has kept those 2017 figures, without any uprating for inflation in the meantime.

Lord Justice Jackson recommended inflation increases every three years by reference to the Services Producer Price Index saying that annual increases would generate too much complexity and confusion in ongoing cases.

He said that insofar as part of the fixed recoverable costs are a percentage of damages that element did not need uprating as the level of damages rises over time to take in to account inflation.

Consequently, it is only the fixed element that needs uprating.

This is a problem anyway, but it is brought sharply into focus by the rapidly increasing levels of inflation.

In fact, according to the Bank of England inflation calculator, the fixed element needed to have increased by 21.9% since 2013, just to stand still, and that was in a period when inflation averaged 2.5 % a year, and clearly it is about to rise sharply.

Even since Lord Justice Jackson’s Report in 2017, there should have been a further increase of 11.19%, just to stand still, with inflation averaging 2.9% a year over thar period.

Lord Justice Jackson uprated the figures by 4% , covering the period from 2013 to 2017, but in fact inflation over that period was 8.9%, averaging 2.2 % a year.

Assessment

In the event of dispute, the court will assess costs. If the case goes to trial, the trial judge will summarily assess costs at the end of the hearing.

If the case does not go to trial, there will be a shortened form of detailed assessment as set out in the last sentence of Practice Direction 47, paragraph 5.7, with a provisional assessment fee cap of £500.

Counsel’s fees

Ring-fenced only in Band 4 of the Fast Fast Track.

In the intermediate fast track counsel’s fees are ring-fenced for all Bands, and not just Band 4 as in the fast fast track.

In all cases where there is ring-fencing of counsel’s fees, they are fixed, and not capable of being a separate disbursement.

County Court Only

The fixed recoveble costs regime is a County Court only regime, and any cases allocated to the multitrack, or dealt with in the High Court, will not be covered.

This means that section 74 (3) of the Solicitors Act applies to all fixed recoverable costs cases, as that section applies to all County Court claims.

This is an important, and relatively little-known provision, and I deal with it in piece –

SECTION 74: KEY COSTS LAW YOU HAVE NEVER HEARD OF

The Indemnity Principle

Here I am referring to the indemnity principle, not indemnity costs.

In

Nizami v Butt [2006] EWHC 159 (QB)

the court held that the indemnity principle did not apply to fixed recoverable costs cases, meaning that whatever the solicitor and own client retainer contained, or did not contain, the paying party had to pay the fixed recoverable costs.

In his 2017 Report, Lord Justice Jackson said, at paragraph 2.8:

“I have previously argued that, in relation to costs, the common law ‘indemnity principle [as compared with indemnity costs] served no useful purpose and should be abolished: see chapter 5 of my Final Report. That argument fell on deaf ears. In those circumstances, the CPR must make it clear that the indemnity principle has no application to FRC.[fixed recoverable costs]”

This rule does not prevent a challenge by the client to her or his own solicitor’s bill under the Solicitors Act 1974.

Amount of Damages on Which Fixed Costs are Based.

If the claimant succeeds, the specified percentage applies to the sum recovered.

If the defendant succeeds, the specified percentage applies to the claim defeated, as valued in the particulars of claim. (Page 106 of the 2017 Report)

Consequently, if, for example, a claimant puts forward a claim of £100,000 for a claim where only £50,000 is likely to be recovered, then they stand to recover costs on the basis of £50,000 but stand to pay costs based on £100,000.

In intermediate cases the highest percentage of damages is 22% (Band 4, Stage 8) and so it follows that, in the example given by me, the claimant stands to recover £11,000 under this element, but is risking £22,000.

Admissions etc.

The fixed recoverable costs are based on the track, band, value and stage reached and whether there has been an early admission, or everything is fought out until the last, the figure is the same.

Having said that, an early admission will generally involve the matter going into a lower, cheaper band.

Influence of Fixed Recoverable Costs on Solicitors Act 1974 Challenges

This is likely to be a very significant issue

Unless a client has been fully and clearly informed as to how fixed recoverable costs work, and that they are an absolute limit on the amount to be recovered from the other side, and the fact that their own solicitor will seek to recover costs over and above those costs from their own client, then these are unlikely to be recoverable from the client.

Section 74 (3) only applies to County Court proceedings, and arguably only once proceedings are issued, but that matter is currently before the Court of Appeal in relation to the appeal against the decision in

Belsner v Cam Legal Services Limited [2020] EWHC 2755 (QB)

and this is due to be heard by 31 July 2022.

However, CPR 46 (9) applies to all solicitor and client retainers, and not just in the County Court, and applies pre-issue as well as post issue.

Below I set out my write up which first appeared in Issue 44 at pages 159-160

COURT BUDGET EXCEEDED: “UNUSUAL COSTS” NOT RECOVERABLE FROM CLIENT: IMPORTANT DECISION,

together with Simon Gibbs’ write up which appears in Issue 44 at pages 161-162

SEEKING COSTS FROM CLIENT IN EXCESS OF APPROVED BUDGET – ST V ZY – Simon Gibbs

of the case of

ST v ZY [2022] EWHC B5 (Costs) (21 February 2022)

where the court refused to allow the solicitors to recover, on a solicitor and own client basis, anything beyond the budgeted costs.

For these purposes for ”budgeted costs” read “fixed recoverable costs”.

The current fixed recoverable costs scheme only applies to personal injury cases, and in such cases the claimant, absent misconduct, is protected by Qualified One-Way Costs Shifting from paying the defendant’s costs, even if they lose.

Part 36

Part 36 was a potential exception to Qualified One-Way Costs Shifting, in the sense that a claimant who accepted a Part 36 offer late, or failed to beat it at trial, risked having the post Part 36 defendant’s set-off against their own pre-part 36 costs or damages.

Following the decisions of the Supreme Court in

Ho (Respondent) v Adelekun (Appellant) [2021] UKSC 43

and of the Court of Appeal in

Cartwright v Venduct Engineering Ltd [2018] EWCA Civ 1654

a claimant is no longer at risk of such set-off, unless there is a court order, that is essentially the matter goes to trial.

A defendant who accepts a claimant’s offer late suffers no penalty, but if at trial the claimant matches or beats its own Part 36 offer, then the claimant gets indemnity costs.

All that changes in all types of cases in the new fixed recoverable costs scheme, both for sub £25,000 claims, and for those valued at between £25,000 and £100,000.

A claimant who matches or beats its own offer at trial will receive a 35% uplift on fixed recoverable costs.

Likewise, if a claimant fails at trial to beat a defendant’s Part 36 offer, then the claimant will pay a 35% uplift on fixed recoverable costs.

The 35% uplift will apply to the fixed costs from the stage in which it expired.

Consequently, as now, the earlier the better is the mantra for Part 36 offers.

The additional benefits of a 10% uplift on damages etc. will remain.

A claimant accepting a defendant’s offer late will pay a 35% uplift for the stage or stages after the expiry of the time for accepting the offer.

It is presumed that that will also be the case for a defendant accepting a claimant’s Part 36 offer late, although that is not the way that the courts have interpreted the existing provisions.

It is presumed that in personal injury claims, the law will remain as it is at present, although it should be noted that in the separate clinical negligence fixed recoverable costs proposals, the claimant will lose some of the existing Qualified One-Way Costs Shifting protection.

I will deal with all of this in much greater detail in the Zoominar on Part 36 at 4pm next Tuesday, 22 March 2022, and there will be a Part 36 Special Newsletter next week.

Counsel’s Fees and Part 36

Under the new fixed recoverable costs scheme, counsel’s fees cannot be claimed as a disbursement, but they are a ring-fenced fixed counsel’s fees in Band 4 of the fast fast track, and in all Bands in the intermediate fast track.

There are three separate types of ring-fenced counsel’s fees:

Stage 2

Stage 7

Stage 11 – Stage 13

Supposing a claimant makes an offer which it matches or beats at trial, and therefore qualifies at for the 35% uplift on fixed costs.

Does that 35% uplift apply to counsel’s ring-fenced fees for the various stages as set out above.

The short answer is that I do not know.

At present counsel’s fees are regarded as a disbursement, but if indemnity costs were awarded, then a higher figure would be paid for counsel’s fees, as they would be paid on the indemnity basis and not the standard basis and, for example, proportionality would not apply.

My preliminary view, but it is only a preliminary view is that the 35% uplift will apply to counsel’s ring-fenced fee.

Here, I have used the example of a claimant matching or beating its own offer, but exactly the same would apply in relation to the fees of counsel instructed by a defendant if a claimant failed to beat the defendant’s offer.

This is specifically stated to avoid the need for detailed assessment “and the keeping of records to inform an assessment.”(my bold)

Unreasonable Behaviour

There will be a fixed percentage uplift of 50% of fixed recoverable costs for unreasonable behaviour.

The stages to which this uplift apply will be decided by the judge on the basis of the nature and extent of the unreasonable behaviour.

There will be no facility within the fixed recoverable costs scheme to order indemnity costs as the Government takes the view that this is disproportionate and will inevitably lead to the need for solicitors to keep time records, and details of what level of fee earner did the work, and would also lead to assessment proceedings.

Thus, the successful party will receive a 50% uplift if it is the other party who has behaved unreasonably. What is not dealt with is the position where it is the successful party which nevertheless has behaved unreasonably in the litigation.

It would make sense to allow the court to reduce the successful party’s costs by 50%, if appropriate.

Interim Applications and Preliminary Issues

There will be fixed recoverable costs for interim injunction applications in Band 4 of the fast fast track and for preliminary issues.

The fixed costs for such applications are in CPR 45.29 H

45.29H

(1) Where the court makes an order for costs of an interim application to be paid by one party in a case to which this Section applies, the order shall be for a sum equivalent to one half of the applicable Type A and Type B costs in Table 6 or 6A.

(1A) Where the order for costs is made in a claim to which the Pre-Action Protocol for Resolution of Package Travel Claims applies, the order shall be for a sum equivalent to one half of the applicable Type A and Type B costs in Table 6A.

(2) Where the party in whose favour the order for costs is made—

(a) lives, works or carries on business in an area set out in Practice Direction 45; and

(b) instructs a legal representative who practises in that area,

the costs will include, in addition to the costs allowable under paragraph (1), an amount equal to 12.5% of those costs.

(3) If an order for costs is made pursuant to this rule, the party in whose favour the order is made is entitled to disbursements in accordance with rule 45.29I.

(4) Where appropriate, VAT may be recovered in addition to the amount of any costs allowable under this rule.

Thus, the fixed recoverable costs of an interim application in Bands 1-3 of the fast track is £250.

In relation to Band 4 cases, CPR 45.29 H (1) will be amended to provide that the fee be 2/3 of the applicable Type A and Type B, that is £333.33.

The fixed recoverable costs for an interim injunction application in the fast fast track should be £750.

All of these figures attract VAT, and where appropriate, London Weighting.

Intermediate Fast Track Cases

The court will decide who shall pay the costs of any interim application in the intermediate fast track and summarily assess them, and any such costs order will be additional to fixed recoverable costs.

THE FAST FAST TRACK – SUB £25,000 CLAIMS

The Bands

Band 1

- Road traffic accident non-personal injury claims, that is damage to vehicles only, including n credit hire claims

- Defended debt claims

- Credit hire claims

Band 2

- Road traffic accident personal injury claims within the existing portal systems

- Package holiday sickness claims

Band 3

- Road traffic accident personal injury claims outside the portal system

- Possession claims

- Housing disrepair claims

- Other money claims

Band 4

- Employers liability disease claims, excluding noise induced hearing loss claims

- Complex possession claims

- Complex housing disrepair claims

- Property disputes

- Professional negligence claims

- Other claims at the top end of the fast fast track

The existing fixed recoverable costs schemes will be absorbed into this scheme.

Band Challenges

On allocation to track, the Judge will also allocate to one of the four Bands in all except multi-track or small claims track matters.

Either party may challenge that decision on paper under CPR3.3 (5) – (6) and the unsuccessful party will pay the successful party costs of £150.

Interim Applications and Preliminary Issues

There will be fixed recoverable costs for interim injunction applications in Band 4 and preliminary issues.

The figures vary, depending upon the band, and I deal with these separately below when looking at the costs generally in the new scheme.

Split Trials

Preliminary issue trials should be avoided in the fast fast track.

If there is a preliminary trial, followed by a subsequent trial, then two trial advocacy fees will be recoverable, but no other additional costs.

The two trials can be in different Bands.

Counsel’s Fees

These are not separately recoverable in Bands 1, 2 and 3 of the fast fast track, and cannot be claimed as a disbursement, thus ending the current ambiguity on this point.

In Band 4 of the fast fast track counsel’s fees will be recoverable as a fixed, ring-fenced sum.

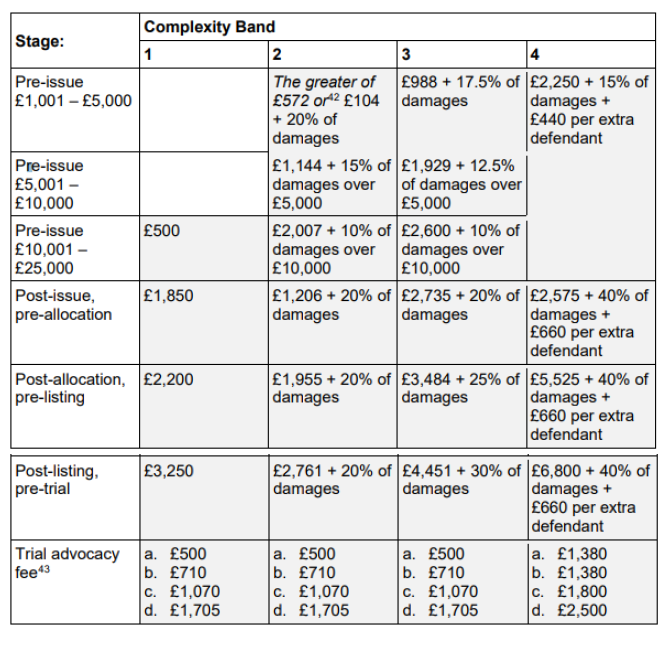

The figures are in the table below.

Business And Property Courts

These matters are excluded from fixed recoverable costs, but have been subject to a capped cost pilot for claims up to £250,000.

Expect fixed recoverable costs to be brought in for claims of up to £250,000, possibly with an extension of the proposals here to £250,000, maybe in 2025.

INTERMEDIATE CASES

These will be in the fast track, subject to a separate procedural regime and to a separate grid of fixed recoverable costs.

Lord Justice Jackson identified the following criteria for intermediate cases.

2.1

i. The case is not suitable for the small claims track or the fast track.

ii. The claim is for debt, damages or other monetary relief, no higher than £100,000.

iii. If the case is managed proportionately, the trial will not last longer than three days.

iv. There will be no more than two expert witnesses giving oral evidence for each party.

v. The case can be justly and proportionately managed under an expedited procedure.

vi. There are no wider factors, such as reputation or public importance, which make the case inappropriate for allocation as an intermediate case.

vii. The claim is not for mesothelioma or other asbestos related lung diseases.

viii. Alternatively, even if none of criteria (i)–(vii) are met, there are particular reasons to allocate it as an intermediate case (of the kind prescribed in paragraphs 3.7–3.8 of his report).

Unsuitable Cases

Lord Justice Jackson said that the following would not usually fit the criteria, and therefore would not be suitable for fixed recoverable costs as intermediate cases, but sub £25,000 claims would be subject to fixed recoverable costs in the fast fast track, and possibly their own bespoke scheme.

Types of Claims Not Included if Valued At More Than £25,000

- mesothelioma/ asbestos

- professional negligence

- actions against the police

- child sexual abuse

- intellectual property

- complex personal injury

- clinical negligence

- noise induced hearing loss

- package holiday sickness claims

Agreeing Track

The Pre-Action Protocols are to be amended to require parties to try and agree the appropriate track, and the appropriate Band for intermediate cases.

Claimants must set this out in the Letter of Claim and defendants must do the same in the Letter of Response.

2.4 We propose that provisional allocation of intermediate cases will be carried out first and foremost on the basis of any agreement between parties regarding the track. If such agreement has not been reached, cases will instead be provisionally allocated according to the value of the claim, with claims for debt, damages, or other monetary relief under £100,000 provisionally so allocated. Parties can challenge allocation via the directions questionnaire, giving their reasons. Allocation will then be reviewed and determined by the judge at the allocation stage. Should a party wish to challenge this further, they may then request a hearing on payment of the appropriate fee. We agree with Sir Rupert that ‘[i]f the only reason for holding a Case Management Conference (CMC) is the dispute about assignment, the unsuccessful party on that issue should incur a costs liability of £300 to the successful party’, but would welcome views on this.

Streamlined Procedure

- statements of case no longer than 10 pages.

- written witness statements as evidence in chief, with a party’s statements limited to 30 pages.

- standard disclosure in personal injury cases; in non- personal injury cases each party will disclose the documents upon which it relies, as well as documents that the court specifically orders.

- oral evidence limited to one expert witness per party (two, if reasonably required and proportionate), with each expert report limited to 20 pages (excluding photographs etc). Oral evidence will be time-limited and directed to the matters identified at the Case Management Conference.

- applications to be made at the Case Management Conference, as much is possible.

- control by the court of the scope and number of interim applications or procedural gamesmanship.

The Four Bands

4.1 As in the fast, fast track, there is a grid of Fixed Recoverable Costs for intermediate cases with four bands of complexity:

- Band 1:

The simplest claims that are just over the current fast track limit, where there is only one issue and the trial will likely take a day or less, e.g. debt claims.

- Band 2:

Along with Band 3 will be the ‘normal’ band for intermediate cases, with the more complex claims going into Band 3.

- Band 3:

Along with Band 2 will be the ‘normal’ band for intermediate cases, with the less complex claims going into Band 2.

- Band 4:

The most complex, with claims such as business disputes and ELD claims where the trial is likely to last three days and there are serious issues of fact/law to be considered.

Personal Injury Cases

- Band 1

Straightforward, quantum-only cases

- Band 2 and Band 3

Where both liability and quantum are in dispute

- Band 4

will be used for cases where there are serious issues on breach, causation, and quantum, but which are still intermediate cases.

Non-Personal Injury Intermediate Cases

- Band 1

Will be used for straightforward cases with only one issue in dispute, such as proving a debt

- Band 2 or Band 3

Most non-personal injury intermediate cases will go into these Bands

- Band 4

Will be used for more complex cases

Challenge to Band Assignment

Either party may challenge the assigned band at the case management conference and if this dispute is the only reason for the case management conference, then the losing party will pay £300 costs to the winning party.

Judicial Review

Subject to a separate procedure.

Relationship With Other Changes

The introduction of Fixed Recoverable Costs in civil claims up to £100,000 should not be seen in isolation, and I set out below a separate piece that I have written in relation to other changes which are likely to come in in the near future.

THE FIGURES

The Fast Fast Track

The figures are cumulative, except for trial advocacy fees, so, for example, the maximum Band 1 fee excluding trial is £3,250; Bands 2 and 3 are the current fast track pre-trial fixed costs in personal injury work with a 4% uplift for inflation since 1 April 2013.

The stages are the same as the existing ones.

I presume that that £1,001 – £5,000 Band will become £1,501 – £5,000 to reflect the rise in the small claim limit in non-road traffic account personal injury work.

Advocacy Fee Categories

- (a) claims up to £3,000;

- (b) £3,001 – £10,000;

- (c) £10,001 – £15,000;

- (d) £15,001 – £25,000

The Intermediate Fast Track

Note that the stages are very different from the existing ones in the fast fast track, and are a mixture of Stage reached and work done.

Thus, the issue of having to do a lot of work, due to court directions, but only getting the pre-listing Stage fee, as compared with the post listing Stage fee, is avoided, so is the anomaly of some courts allocating and listing at the same time, thus moving through two stages immediately or not.

The shaded areas are cumulative; the unshaded areas are free-standing add-ons, that is ring-fenced counsel’s fees for drafting the statement of case, advising pre-trial, and all advocacy matters.

There is no advocacy fee if the matter settles before trial, and it is presumed that, as with the existing, this will be if it settles before the day of trial.

However, there is a ring-fenced counsel/ specialist lawyer fee for advising in writing or in conference provided that it is no more than 14 days before trial.

Counsel’s fees

Ring-fenced only in Band 4 of the Fast Fast Track.

In the intermediate fast track counsel’s fees are ring-fenced for all Bands, and not just Band 4 as in the fast fast track.

In all cases where there is ring-fencing of counsel’s fees, they are fixed, and not capable of being a separate disbursement.