Archive for March 2024

Fixed Costs Zoominars : Next one this afternoon!

I am conducting a series of three 1-hour Zoominars dealing with Fixed Recoverable Costs and the cost for all three is £150 plus VAT, it is a £180.

The first one took place on 16 January 2024 and a link to the recording is available and covers amongst other things:

– Contracting Out;

– Inquest Costs;

– Company Restoration Proceedings Costs;

– Counsels’ Fees on Late Settlement;

– Conflicting Provisions on Settlement Pre-Issue;

– Defendants’ Right to Costs if Discontinued Pre-Issue;

– Part 36;

– Track Allocation and Band Assignment;

– The Conundrum re Civil Proceedings unissued by 1 October 2023.

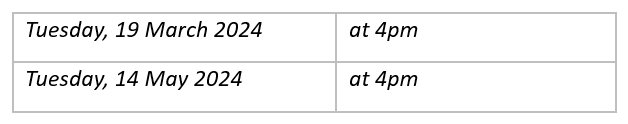

The next ones are:

Tuesday, 19 March 2024 at 4pm

Tuesday, 14 May 2024 at 4pm

The one this afternoon 19 March 2024 will cover the amendments to the Fixed Recoverable Costs Scheme coming in on 6 April 2024, including:

- Inflation uprated figures for all fast track and intermediate track claims, and the Noise-Induced Hearing Loss Scheme

- Advocates Fees in Cases Settled late or Vacated

- Fixed Recoverable Costs on Assessment

- Fixed Costs in Part 8 (Costs only claims)

- Inquests

- Restoring a Company to the Register

- Clinical Negligence

- Directions

- Length of Expert Reports

- Part 36

- Contracting Out

- Case Management

- Future Developments

As many colleagues as you like from your organisation can attend and recordings sent whether or not you attend.

To book a place, click here.

Fixed Recoverable Costs Autumn 2023 Extensive Course Material

You can also purchase my detailed Course Material on Fixed Recoverable Costs from Autumn 2023, fully updated to take account of recent changes.

The cost is £150 plus VAT total £180, and you can buy here.

Documents Subscription

I have updated completely the Documents, Videos, Agreements and Advices Menu and this contains 39 new Conditional Fee Agreements suitable for Fixed Recoverable Costs cases, covering Civil Litigation as well as Personal Injury and Clinical Negligence.

You can purchase the entire hyperlinked suite of all documents, and not just the Conditional Fee Agreements, here for £2,000 plus VAT for the first year.

If you wish to renew for 2025 and beyond the cost reduces to £1,000 plus VAT to reflect the fact that much of the benefit is gained in the first year.

This subscription includes the thrice weekly Newsletter Kerry On Costs, Regulation, Legal Systems And So Much More…

Kerry on Costs Regulation Legal Systems and So Much More

The above Newsletter subscription itself costs £500 plus VAT for each year and you can purchase it here.

Subscription to the Documents Service, or the Newsletter Service, includes free attendance for as many people as you want from your organization at the two upcoming Zoominars, plus the recording of the Zoominar which has already taken place.

CLOSE THE COMMERCIAL COURT TO FOREIGN LITIGANTS UNTIL COUNTY COURT BACKLOG IS CLEARED

This appeared in the newsletter KERRY ON COSTS, REGULATION, LEGAL SYSTEMS AND SO MUCH MORE… which comes out electronically 2 or 3 times a week. Subscription for a year – so to 31 March 2025 is £500 plus VAT – total £600.

You can find out more and book here.

If you would like 4 sample copies free, please contact Kerry on kerry.underwood@lawabroad.co.uk.

All people in your organisation are included in that price. It includes free access to Zoominars – the next ones-on Fixed Costs are on

plus a recording of the one that has already taken place.

The Ministry of Justice: Civil Justice Statistics Quarterly published in Issue 230, showed, amongst other things, that the average time for a Small Claim to reach trial or first hearing is now 55.8 weeks, that is over one year.

That is an average and there is anecdotal evidence that in some courts in Southern England the time is around two years.

The figures appear not to take into account hearings that are adjourned, because there is no Judge to hear them.

Any which way, it is a hopeless failure of the system.

Throw in the Pre-Action Protocols, and you can add another three months.

The reality is that anyone can avoid paying a debt for the best part of 18-months simply by filing some sort of Defence, and even if they lose at the end of the day, or more likely admit shortly before trial, no costs are payable.

The Small Claims Limit is £10,000, which is not a small amount for most individuals or small businesses.

These delays do huge harm to the functioning of businesses and the domestic economy generally, which is driven by small- and medium-sized enterprises.

Evening and weekend courts should be set up to clear this backlog with former judges being brought in to assist.

It is this sharp end that really matters, not the big fee Commercial Court where 64% of cases had at least one non-UK party and 40% were entirely non-UK based.

They may earn fat fees for lawyers, but this is an intolerable use of resources when the County Courts are literally and metaphorically falling apart.

Am I saying that Commercial Court Judges should be freed up to assist the County Court backlog?

If necessary, yes.

FIXED RECOVERABLE COSTS – CPR 45.13

This appeared in the newsletter KERRY ON COSTS, REGULATION, LEGAL SYSTEMS AND SO MUCH MORE… which comes out electronically 2 or 3 times a week. Subscription for a year – so to 31 March 2025 is £500 plus VAT – total £600.

You can find out more and book here.

If you would like 4 sample copies free, please contact Kerry on kerry.underwood@lawabroad.co.uk.

All people in your organisation are included in that price. It includes free access to Zoominars – the next ones-on Fixed Costs are on

plus a recording of the one that has already taken place.

In my piece – PART 36, FIXED RECOVERABLE COSTS AND CLAIMANT’S LATE ACCEPTANCE – I looked, amongst other things, at the fact that both parties can get costs from each other for the same work!

Simon Gibbs, the Expert Defence Costs Lawyer, whose excellent blog is here, in his piece – Fixed Recoverable Costs – CPR 45.13 looked at the apparently unintended prospect of a double sanction for unreasonable conduct, which can arise because both parties get costs, and as we have seen in the lengthy article above, both parties can get costs for the same work in the same stage, as that is how late acceptance of a Part 36 offer works.

Thus, a claimant accepts late in the same Stage that the offer expired.

Both parties get full costs from the other side for all the work in that stage (yes, honestly!)

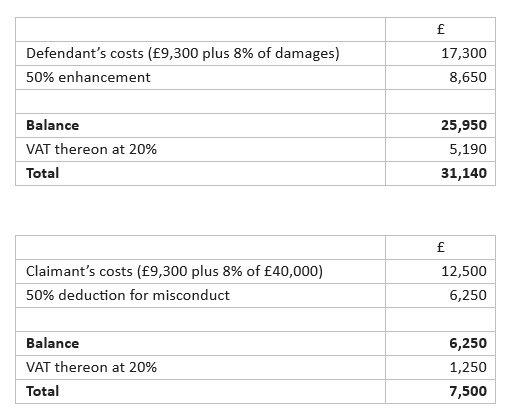

Let us say that the defendant successfully argues unreasonable conduct.

Does the defendant get both a 50% increase in its own costs for that Stage, and a 50% reduction in the costs that it has to pay the claimant for that Stage?

On the face of it, yes.

As will be seen above, we have no idea whether the defendant gets costs based on the amount accepted, or claimed, as there are directly contradictory rules on this point within the Civil Procedure Rules.

Let us make it easy and take a Stage 1 personal injury case, where costs are fixed, as compared with a civil case where costs are capped, and not fixed, which makes it much more complicated.

The claimant claims £100,000 and accepts late for £40,000.

The claimant’s conduct is held to be unreasonable.

These are the consequences:

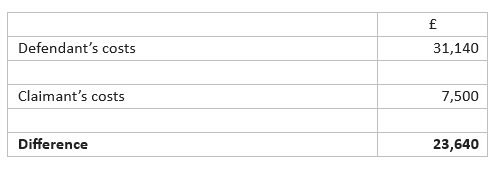

Difference between defendant’s costs and claimant’s costs:

Script of explanation to client:

I have good news for you. We have won your case and accepted the other side’s offer of £40,000 which you were very happy about.

I was a bit busy and was a few minutes late accepting their offer, and I am afraid that has cost you £23,640.

I was five minutes late and so the defendant was on an hourly rate of £283,680. Sorry!

You will receive only £16,360 from the other side.

The good news is that I capped all my charges to you at 30% of damages, so that is £12,000.

This means that you will receive £4,360 out of the £40,000.

PART 36, FIXED RECOVERABLE COSTS AND CLAIMANT’S LATE ACCEPTANCE

This appeared in the newsletter KERRY ON COSTS, REGULATION, LEGAL SYSTEMS AND SO MUCH MORE… which comes out electronically 2 or 3 times a week. Subscription for a year – so to 31 March 2025 is £500 plus VAT – total £600.

You can find out more and book here.

If you would like 4 sample copies free, please contact Kerry on kerry.underwood@lawabroad.co.uk.

All people in your organisation are included in that price. It includes free access to Zoominars – the next ones-on Fixed Costs are on

plus a recording of the one that has already taken place.

I am very grateful to Simon Gibbs, the Expert Defence Costs Lawyer, whose excellent blog is here, for his input into this piece, and, frankly, for putting me right.

I had assumed, wrongly, that a claimant’s late acceptance within the same stage of a Fixed Recoverable Costs case would have no adverse costs consequences as the moment the claimant enters that stage, they get the full fixed costs for that stage and that remains the case, and the sum remains the same, until the next stage is entered.

That would seem to me logical and sensible, which is no doubt why I wrongly assumed that that was the end of the story.

What in fact happens, bizarrely in my view, is that late acceptance, even by a day, means that both parties get Fixed Recoverable Costs from each other for that stage.

What the Civil Procedure Rules could have said, but do not, is that where a claimant accepts a defendant’s offer after the expiry period, but within the same stage that it was made, then neither party gets costs for that stage.

That is not what it says, and you might think that it is the same hill of beans, as both parties getting costs from each other for the same stage, cancels each other out. That is not necessarily the case.

Not only does it mean that the claimant gets nothing for that stage, but they will actually get less than nothing as the defendant’s costs for that stage will always be higher than those of the claimant.

I make that statement boldly, but I will look later at the stark contrasts between CPR 45 and CPR 36, which means that I simply do not know if that is correct.

The logic behind me saying that is that the claimant receives costs on the basis of the amount settled for, that is the value of the Part 36 offer, whereas the claimant pays costs on the basis of the sum claimed.

It is certainly the case that the claimant receives costs on the basis of the amount settled for, but in a Part 36 case, it is unclear whether the claimant pays costs on the basis of the sum claimed, or the sum settled for, and I look at that later.

It is hard to think of any case where the Part 36 offer by the Defendant is going to be for everything claimed by the claimant, and therefore, one would always expect the amount settled for to be less than the amount claimed.

The relevant Rules in relation to this point are CPR 36.23(3), (8), and (9).

These read:

“(3) Subject to paragraphs (4) and (5), where a defendant’s Part 36 offer is accepted after the relevant period—

(a) the claimant is entitled to—

(i) the fixed costs in Table 12, Table 14 or Table 15 in Practice Direction 45 for the stage applicable at the date on which the relevant period expired; and

(ii) any applicable additional fixed costs allowed under Section I, Section VI, Section VII or Section VIII incurred in any period for which costs are payable to them; and

(b) the claimant is liable for the defendant’s costs in accordance with paragraph (8).

(8) Subject to paragraph (9) where the court makes an order for costs in favour of the defendant, the defendant is entitled to—

(a) the fixed costs in Table 12, Table 14 or Table 15 in Practice Direction 45 for the stage applicable at the date of acceptance; and

(b) any applicable additional fixed costs allowed under Section I, Section VI, Section VII or Section VIII incurred in any period for which costs are payable to them,

less the fixed costs to which the claimant is entitled under paragraph (3)(a)(i) or (4).

(9) Where—

(a) an order for costs is made pursuant to paragraph (3); and

(b) the stage applicable at the date on which the relevant period expires and the stage applicable at the date of acceptance are the same,

the defendant is entitled to the fixed costs applicable to that stage.”

Thus, the claimant does indeed get all its fixed costs of the stage in which the Part 36 offer is accepted, whether accepted in time, or late.

That is the effect of CPR 36.23(3)(a)(i).

So far, so good.

However, CPR 36.23(3)(b) provides that the claimant is liable for the defendant’s costs in accordance with Paragraph (8).

Paragraph (8) provides that where the court makes an order for costs in favour of the defendant, the defendant is entitled to the fixed costs for the stage applicable at the date of acceptance less the costs due to the claimant for the same stage.

The very fact that the Rules state that, suggests that the costs may be different, for the reasons set out above, that is a claimant getting costs on the basis of the amount settled for, and the defendant getting costs on the basis of the amount claimed.

Otherwise, as mentioned above, it would have been far simpler to say that where an offer is accepted late within the same stage, neither party gets costs for that stage.

Paragraph (8) is subject to Paragraph (9) which provides at (b) that where the stage application at the date on which the relevant period expires and the stage applicable at the date of acceptance are the same, the defendant is entitled to the fixed costs applicable at that stage.

Again, that suggests that the defendant gets its costs on the basis of the amount claimed, and not settled for, which is what CPR 45.6(2) and (3) say and I set this out below:

“(2) For the purpose of assessing the costs payable to a defendant by reference to the fixed costs in Table 12 and Table 14—

(a) “value of the claim for damages” and “damages” shall be treated as references to the value of the claim, as defined in paragraph (3); and

(b) if the claim is discontinued, a reference in Table 12 or Table 14 to the stage at which a case is settled shall be treated as a reference to the stage at which the case is discontinued.

(3) For the purposes of paragraph (2)(a), ‘the value of the claim’ is—

(a) the amount specified in the claim form, without taking into account any deduction for contributory negligence, but excluding—

(i) any amount not in dispute;

(ii) interest; or

(iii) costs;

(b) if no amount is specified in the claim form, the maximum amount which the claimant reasonably expected to recover according to the statement of value included in the claim form under rule 16.3;

(c) if the claim form states that the claimant cannot reasonably say how much is likely to be recovered—

(i) £25,000 in a claim to which Section VI applies; or

(ii) £100,000 in a claim to which Section VII applies;

(d) if the claim has no monetary value—

(i) the applicable amount in rule 45.45(1)(a)(ii) in a claim to which Section VI applies; or

(ii) the applicable amount in rule 45.50(2)(b)(ii) in a claim to which Section VII applies; or

(e) if a claim includes both a claim for monetary relief and a claim which has no monetary value, the applicable amount in sub-paragraph (d) taken together with the applicable monetary value in sub-paragraph (a), (b) or (c).”

I return to that subject later.

So, that appears to be that, although I am not sure what CPR 36.23(9) brings to the table that is not already covered by CPR 36.23(8).

The Effect

A non-personal injury claimant receives an offer in Stage 1 which expires a day before the Defence is filed, triggering the matter to go into Stage 3, something which the defendant can control and engineer.

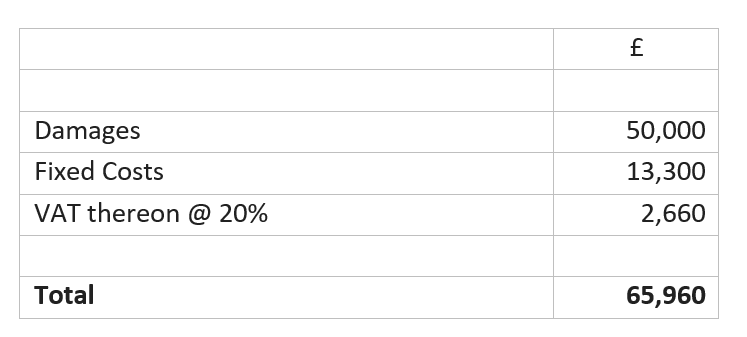

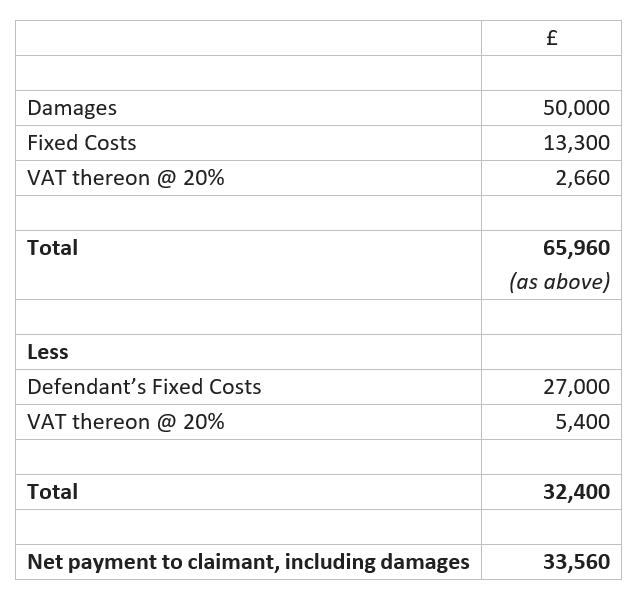

The claim is for £100,000 and settles for £50,000 due to uncertainties which both parties accept and which would have led to the matter being assigned to Complexity Band 4.

The claimant accepts in time.

The claimant will get Stage 1 costs to be assessed, not fixed in non-personal injury matters, but subject to a cap at the Fixed Recoverable Costs sum for Stage 1.

So, the client gets £50,000 plus assessed costs subject to a cap of £13,300, plus VAT, that is

£9,300; plus

8% of damages; plus

VAT.

Let us assume that the claimant accepts two days late and is now in Stage 3, because the filing of the Defence has moved the matter from Stage 1 to Stage 3.

Please do not get me started on why Stage 3 is called Stage 3 rather than Stage 2. I have written about that extensively, and this piece will be long enough in any event.

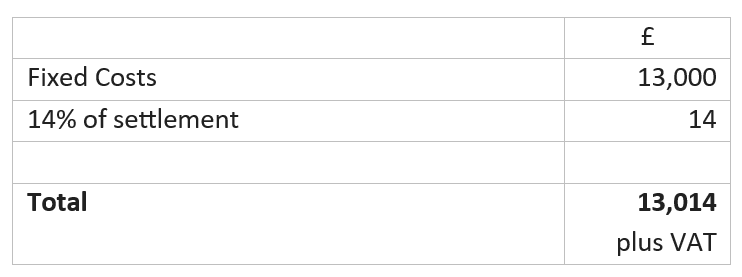

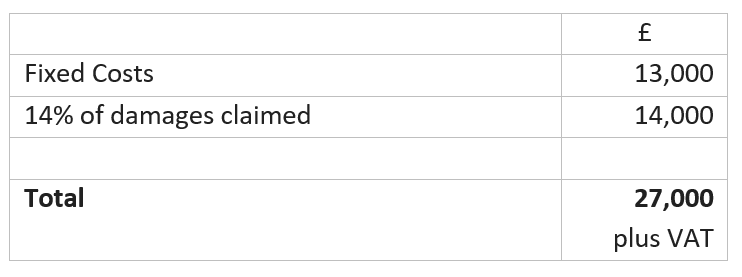

It appears that the defendant gets £27,000, being the fixed fee of £13,000; plus

14% of the £100,000 damages claimed.

That is subject to a further discussion below.

What does the claimant get?

I do not know.

The maximum is clearly £13,300 as set out above, but whether that becomes fixed, and not capped, as the matter is now in Stage 3, retrospectively fixed in Stage 1 costs, I do not know.

As the time for acceptance expired in Stage 1, is the claimant only entitled to assessed costs on the basis of work done, subject to the Stage 1 cap, or to fixed Stage 1 costs?

Either way, the claimant is at least £13,700 plus VAT worse off, so that is £16,440, or one third of the damages in this example.

In personal injury cases, the Stage 1 costs are fixed, and Qualified One-Way Costs Shifting applies.

If the claimant accepts in time, she/he gets:

If the claimant accepts late in Stage 3, then the position is:

Thus, two days, when maybe no work at all was done, costs to the claimant of £33,560, that is virtually half the award.

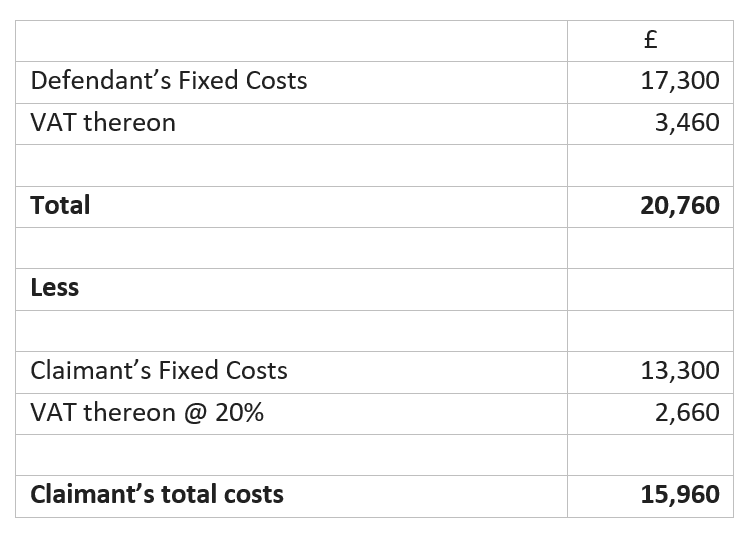

What happens if the claimant accepts late in the same Stage – let us assume Stage 1 – and proceedings have been issued?

I make this qualification about proceedings being issued as it remains unclear as to whether a defendant can ever recover costs in an un-issued matter.

In a personal injury claim on the above figures, it would look like this:

Thus, the claimant owes the defendant £4,800 which will be set off against damages.

Incidentally, the claimant’s solicitor could presumably claim a success fee of up to £12,500, being 25% of the damages, and less than the maximum 100% uplift on Solicitor and Own Client costs, even on a recovered costs basis, even though in reality, the claimant is paying out costs to the defendant!

In a non-personal injury case, each side’s costs will be assessed if the matter resolves in Stage 1, but after expiry of time for accepting the defendant’s Part 36 offer.

However, the claimant’s costs would be capped at £15,960 including VAT and the defendant’s costs at £20,760 including VAT, even if the defendant had done only a fraction of the work that the claimant had done.

In non-personal injury matters, there is no damages-based cap on the amount of the success fee that the solicitor can charge, and therefore, the success fee alone in the above case could be £15,960 even though in reality, the claimant is receiving no costs, and is paying out £4,800 net to the defendant.

There will be some interesting Solicitor and Own Client challenges under the Solicitors Act 1974 coming up.

Having said all of that, I am not sure that I am correct in stating that the defendant gets Fixed Costs on the basis at the amount claimed.

This is unquestionably the general position in Fixed Recoverable Costs cases, as that is what CPR 45.6(2) and (3) say, and I have set those provisions out above.

However, in a stand-alone throw away provision, CPR 36.23(6) says:

“(6) Fixed costs shall be calculated by reference to the amount of the offer which is accepted.”

It is not clear whether that refers only to a claimant’s costs, or to both parties’ costs, including the defendant’s costs, and CPR 36.23(6) appears after CPR 36.23(3) which I have set out above, and which deals with late acceptance.

That would have the bizarre effect that the more the defendant’s solicitors get the settlement down, the less they get in costs, albeit the defendant will be paying lower damages.

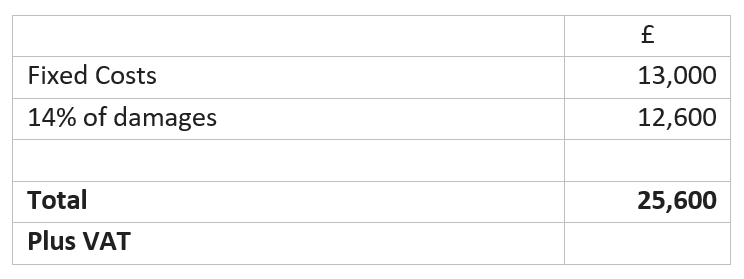

So, £100,000 is claimed, and the claimant accepts £90,000 late in Stage 3 when the time for accepting expired in Stage 1.

The defendant’s costs are £25,600 plus VAT comprised of:

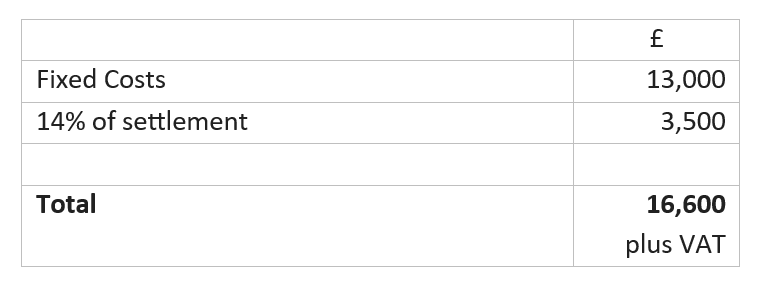

Same claim, same timescales, but the claim settles for £25,000.

The defendant gets:

Thus, for achieving a far better result for the defendant, the defendant’s Fixed Recoverable Costs are reduced by £9,500 plus VAT.

If the claimant accepted £100, then the defendant would get:

If the claimant accepted nothing and discontinued the claim, then the defendant would get:

In any event, there is no doubt that rather than softening the effect of late acceptance within the same stage, as I originally thought, the new scheme is very much harder on late accepting claimants than the old scheme.

A late accepting defendant still suffers no penalty whatsoever.

With all due modesty, I reckon I know a little bit about Fixed Recoverable Costs, and a little bit about Part 36.

I have not got a scooby-doo what the position is.

I repeat my thanks to Simon Gibbs – over to you Simon.