Archive for June 2024

FIXED COSTS AND NON-PARTY COSTS ORDERS

This piece first appeared in my twice weekly Newsletter – Kerry On Costs, Regulation, Legal Systems And So Much More…

Subscription runs until 31 July 2025 for approximately 100 Issues and is £500 plus VAT, and can be booked here.

This includes free access to all my Zoominars, together with a recording.

Are applications for Wasted Costs Orders and/or Non-Party Costs Orders in Fixed Recoverable Costs cases themselves subject to the Fixed Costs for applications, or not?

If a Non-Party Costs Order or Wasted Costs Order is made, then are the costs made under any such order themselves to be assessed in the old-fashioned way, or limited to the recoverable Fixed Costs?

The short answer is that I do not know whether an order under Section 51 of the Senior Courts Act 1981, which deals with Non-Party Costs Orders and Wasted Costs Orders is subject to Fixed Recoverable Costs in a Fixed Recoverable Costs case, or not.

The reason I do not know is that the Rules are silent on the matter.

Section 51(1) reads:

“(1) Subject to the provisions of this or any other enactment and to rules of court, the costs of and incidental to all proceedings in—

(a) the civil division of the Court of Appeal;

(b) the High Court; and

(ba) the family court;

(c) the county court,

shall be in the discretion of the court.”

That sub-section gives the court a very wide discretion indeed in relation to costs, but it is specifically:

“subject to the provisions of this or any other enactment and to rules of court…”

Section 51(2) specifically provides that such Rules may make provision for regulating matters relating to the costs of those proceedings including, in particular, prescribing scales of costs to be paid to legal or other representative.

Sub-section (3) is very wide indeed:

The court shall have full power to determine by whom and to what extent the costs are to be paid.

On balance, but only on balance, my view is that the Fixed Recoverable Costs scheme, and the Civil Procedure Rules governing that scheme, mean that any application in a Fixed Recoverable Costs case, including an application under Section 51 of the Senior Courts Act 1981 is subject to Fixed Recoverable Costs.

Following the same logic, my view is that if a Non-Party Costs Order is made, then in a Fixed Recoverable Costs case, it is for Fixed Recoverable Costs.

If there is unreasonable conduct in a Fixed Recoverable Costs, then the court must increase the total of fixed costs payable by 50%, and although a Non-Party Costs Order does not always mean that there has been unreasonable conduct by the non-party, it is likely to do so, and therefore, the award is likely to be for 150% of costs.

Wasted costs, which are a species of Non-Party Costs Orders in the sense that the lawyer, not a party to the action, is ordered to pay the costs are dealt with in sub-sections (6) and (7) which read:

“(6) In any proceedings mentioned in subsection (1), the court may disallow, or (as the case may be) order the legal or other representative concerned to meet, the whole of any wasted costs or such part of them as may be determined in accordance with rules of court.

(7) In subsection (6), “wasted costs” means any costs incurred by a party—

(a) as a result of any improper, unreasonable or negligent act or omission on the part of any legal or other representative or any employee of such a representative; or

(b) which, in the light of any such act or omission occurring after they were incurred, the court considers it is unreasonable to expect that party to pay.”

Taking the provisions together, again, but only on balance, my view is that a Wasted Costs Order is limited to Fixed Recoverable Costs as the maximum Wasted Costs must be the full Fixed Recoverable Costs sum, plus of course the 50% for unreasonable conduct.

In a Wasted Costs Order, it is hard to see how there would not be that 50% uplift for unreasonable conduct.

The purpose of a Non-Party Costs Order is generally to allow the recipient of costs to enforce the order against another party, generally where that party has controlled or funded the litigation. It is in a sense an indemnity to allow a receiving party to enforce against another party, often when the actual party is insolvent.

It would be a strange situation if the receiving party could obtain an order for costs in a much greater sum against a non-party as compared with the actual losing party.

The principle is the same in relation to a Wasted Costs Order, as it would mean that the winning party would be financially better off as a result of the misconduct of the losing party, over and above the 50% unreasonable conduct penalty.

All of this is predicated on the basis that the Civil Procedure Rules have modified Section 51 of the Senior Courts Act 1981, as specifically allowed by that Section itself.

COSTS UPDATES TO CLIENTS IN FIXED RECOVERABLE COSTS CASES

This piece first appeared in my twice weekly Newsletter – Kerry On Costs, Regulation, Legal Systems And So Much More…

Subscription runs until 31 July 2025 for approximately 100 Issues and is £500 plus VAT, and can be booked here.

This includes free access to all my Zoominars, together with a recording.

The key difference between Fixed Recoverable Costs cases and all others is that the costs are not dependent directly upon the work done.

There is an indirect dependence in the sense that the Fixed Recoverable Costs increase as the case proceeds through the stages, whether in the Fast Track or the Intermediate Track.

Moving from one stage to another has an immediate and dramatic impact on the level of Fixed Recoverable Costs.

Outside the field of personal injury that cuts both ways; a claimant’s exposure in the event of defeat or discontinuance increases, as well as the level of costs to be recovered from the other side, in the event of success or on settlement.

In personal injury cases, the claimant enjoys the protection of Qualified One-Way Costs Shifting, and thus in the absence of any extant Part 36 offer made by the defendant, and thus putting the personal injury claimant at risk on costs by way of set-off, there is no costs disadvantage to such a claimant in moving to the next stage.

Thus, in addition to updating clients on the basis of a report every three months or whatever, solicitors should update clients on costs when a matter is about to enter into another stage.

As well as advising on the increase in costs, solicitors should advise on the consequences in relation to any extant Part 36 offer, whether made by the solicitor’s own client or the other side.

The interplay between Part 36 and fixed costs is both complicated and unclear and I have written on that topic:

PART 36, FIXED RECOVERABLE COSTS AND CLAIMANT’S LATE ACCEPTANCE

and

In any event, solicitors should consider whether to revise, update or amend any Part 36 offer, and, if none has been made, to consider making such an offer, and to do a file note as to what action has, or has not, been taken and why.

The imminent movement from one stage to another should always be the occasion for a detailed file review.

Advising pre-allocation on the likely track that the matter will be allocated to, should not cause significant problems, as the main determinant will be the value of the claim.

Thus, the starting point is the claims valued at £10,000 to £25,000 will be in the Fast Track and those between £25,000 and £100,000 will be in the Intermediate Track.

Which Complexity Band the matter is likely to be assigned to is much more complicated.

The maximum information should always be given to the client and if there are uncertainties, then these should be explained to the client, with the consequences of the potential different scenarios explained.

Thus, if the solicitor is confident that the matter will be in the Intermediate Track, but unsure as to, for example, whether it would be Complexity Band 3 or 4, then the reason for that uncertainty should be explained together with worked through scenarios of what will happen in the different bands.

The actual figures involved in the different scenarios should be straightforward; after all the recoverable costs are fixed.

The costs update to the client in relation to solicitor and own client costs will depend upon the nature of the retainer.

Although the indemnity principle does not apply in Fixed Recoverable Costs cases – Nizami v Butt – the client is still only liable to pay her or his own solicitor what is in the retainer, irrespective of the fixed recoverable costs recovered.

If the retainer is related to Fixed Recoverable Costs, e.g. Fixed Recoverable Costs plus 50%, then there is little problem.

However, if a retainer is still charging on hourly rate, then there is.

Let us assume that it is a civil case, and the client has been billed in full to date.

The matter now moves through the stages.

Example

A civil claim valued at £100,000 moves from Stage 1 to Stage 3, which is in fact the next stage as Stage 2 is a completely separate matter relating to counsels’ fees.

Whilst the matter is in Stage 1, the costs are capped and not fixed.

So let us assume that £5,000 worth of work has been done.

The client has been updated and billed.

A defence is then served.

That moves the matter into Stage 3 without the claimant’s solicitor having done one minute’s extra work.

The recoverable costs jump from £13,000 to £27,420.

This is assuming a potential Complexity Band 4 case, and as Stages 1 and 3 are both pre-allocation and assignment stages, this is a best guess, and not a certainty.

Pre-issue in a civil matter, the costs are capped not fixed, but the add on of 8% of damages is fixed.

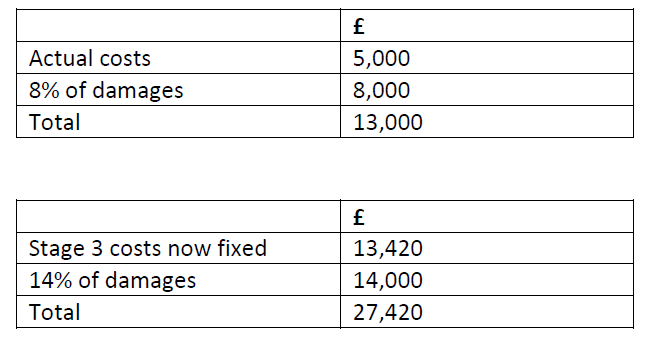

So the calculation is:

Thus, the act of a defence being served, without any work on behalf of the claimant’s solicitor, more than doubles the costs. The actual increase is £14,420.

Even at a rate of £300 per hour, that requires 48 hours additional work before the client is liable for the amount that will be recovered from the other side.

The Fixed Recoverable Costs jump as set out.

Of course, if the retainer is an hourly rate one, pure and simple, then there is no right to charge the client a sum equivalent to 8% of the damages or whatever. The solicitor cannot charge the client any more than £5,000, but more can be recovered from the other side.

Thus, the position is as follows:

The effect of this is that the solicitor has to pay to the client £22,420 being the surplus recovered from the other side as compared with the amount payable by the client under the retainer.

I strongly advise against having any hourly rate retainer with a client in a Fixed Recoverable Costs case.

As will be seen in that example, the solicitor will be jeopardizing and jettisoning 81.77% of the Fixed Recoverable Costs.

That extra, over and above the amount that the solicitor is entitled to charge their own client, belongs to the client, and must be paid to the client, unless the retainer is carefully worded.

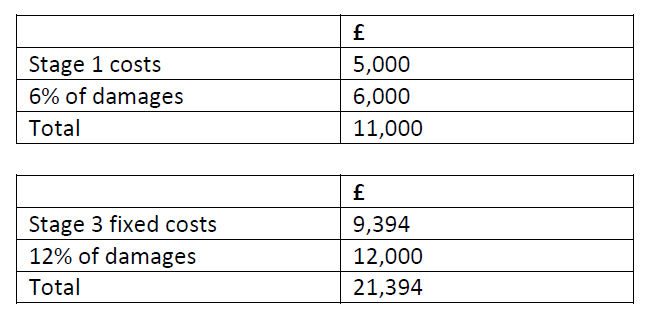

Let us look at the issue alluded to above, where it is not clear whether the matter will be assigned to Complexity Band 3 or 4, and that seems to me the most likely area of uncertainty between the various bands.

The scenario is the same as above, that is a civil claim valued at £100,000 with the actual costs of the hourly rate in Stage 1 being valued at £5,000.

The picture is now like this:

The issues in relation to solicitor and own client costs remain the same, but the client needs to be advised in detail of the different scenarios and the fact that the recoverable costs in Band 4 are £6,026 higher than in Band 3.

All these figures have VAT added to them.

These are significant sums of money and the difference in costs between whether the matter is Band 3 or Band 4, and the potential effect on the client, dwarf the typical success fees in personal injury cases which led to a torrent of solicitor and own client assessments under the Solicitors Act 1974.

One of the unforeseen consequences of fixed costs is the need to give the client much more costs information.

The Legal Ombudsman’s Good Costs Service Guide, which I covered extensively in Issue 217 has considerable information on good costs practice in Fixed Recoverable Costs cases.

One point to notice is that solicitors must deliver a bill to a client for all costs, whoever pays them, and this is obviously relevant in Fixed Recoverable Costs cases where the arrangement may be that the client is charged nothing beyond Fixed Recoverable Costs, or more likely, that Fixed Recoverable Costs are used as the method of calculating costs to the client, e.g. the solicitor and client retainer may be 150% of Fixed Recoverable Costs.

I set out below the law on the fact that solicitors must deliver a bill to a client and that the costs belong to the client in any event.

Solicitors Must Deliver Bill to Client For All Costs, Whoever Pays Them

I am aware that many solicitors do not deliver bills to clients for costs received from another party, for example from the other side in litigation.

This practice is wrong, and solicitors must always deliver a bill to a client for all costs of any kind.

Failure to do so means that not only the client, but the paying party, can challenge the bill and time does not begin to run until the delivery of the statute bill.

Section 39 of the Limitation Act 1980 reads:

Section 39 Saving for other limitation enactments

This Act shall not apply to any action or arbitration for which a period of limitation is prescribed by or under any other enactment (whether passed before or after the passing of this Act) or to any other action or arbitration to which the Crown is a party and for which, if it were between subjects, a period of limitation would be prescribed by or under any such other enactment.

Consequently, a client, or paying party, can challenge costs that are 10 or 20 years old, or whatever, where no statute bill has been delivered.

The original authority for the fact that a solicitor must always deliver a bill to the client for all costs is

Cobbett v Wood [1908] 2 KB 420, Court of Appeal.

The issue was more recently considered in the case of

Allen v Brethertons LLP [2018] EWHC B15 (Costs) (02 October 2018)

in the context of fixed recoverable costs in the portal, all of which were recoverable from the defendant.

Even in that situation, the courts said a bill must be delivered and that recoverable costs always belonged to the client and not the solicitor and that applies even to fixed recoverable costs – see paragraph 51.

There is an exception to the indemnity principle in relation to fixed recoverable costs and that follows from the decision in

Butt v Nizami [2006] EWHC 159 (QB)

but as the court recognized here at paragraph 51, that only applies in fixed recoverable costs cases.

The court also quotes from Cobbett v Wood:

“… The bill of fees, charges, and disbursements contemplated…” (by statute) “…

is, I think, a complete bill of the whole of the fees, charges, and disbursements in

respect of the particular business done….”

For what it is worth, the court in that case also considered that there was a breach of the Solicitors Regulation Authority accounts rules in money going to office account without a bill to the client being delivered.

Recoverable Costs

The guide stresses the importance of clients understanding at the outset how costs recovery works and in particular whether the client’s liability to the lawyer is likely to exceed the costs recovered from the other side, and if so, by how much.

Outside the field of Fixed Recoverable Costs, clients should always be fully informed and involved in relation to negotiations concerning the recovery of costs from the other side as the level of recovery is likely to determine the amount that the clients have to pay themselves.

My advice is that clients should be fully informed at all stages concerning costs budgets, costs schedules, etc, and copied into any correspondence with the other side on these matters.

Information and informed consent is the name of the game.

Fixed Recoverable Costs

The Guide states that the above issues are particularly important in cases subject to Fixed Recoverable Costs as there may be a greater difference between Solicitor and Own Client charges and the Fixed Recoverable Costs, that is the costs to be obtained from the other side.

The guide refers to costs incurred by the solicitor on a time spent basis, but my advice is not to use hourly rates in Fixed Recoverable Costs cases, and I have written extensively about this.

Capping all costs to the client

The Guide suggest the approach of capping the client’s whole costs liability to a percentage of damages.

That is of course the Underwoods Method, recommended by the Court of Appeal in Belsner and now advocated by the Legal Ombudsman.

It has taken a while… 29 years to be precise.

The Ombudsman gives further guidance, which I analyse here.

Recoverable Costs in Fixed Recoverable Costs Cases

In cases where costs are recoverable from another party, it is important that clients understand how costs recovery works, and whether the liability to the lawyers can exceed recovered costs and who will be liable for any shortfall.

The Ombudsman suggests that this is particularly important in Fixed Recoverable Costs cases, where the shortfall may be greater.

The Ombudsman then goes on in an important piece of advice to say that one possible approach is to cap the client’s liability to a certain proportion of damages such as by saying

“You remain liable to pay any costs which we cannot recover from your Opponent, but we will limit your liability to [X]% of the compensation you recover”.

This can be an effective way of addressing the risks of shortfalls, so long as the capping arrangement is explained clearly at the outset.

This is an important piece of advice, and is the Underwoods Method, approved by the Court of Appeal in Belsner and now sanctioned by the Legal Ombudsman.

Significantly, they use “X” and do not suggest any particular percentage as a maximum.

In a worked example in this publication, they approved a 30% deduction in a personal injury claim.

The point to note is that it is only the success fee, and not the overall costs, where there is a 25% cap on damages.

It is no coincidence that the Ombudsman has used this example; they must have had hundreds of cases where 25% was the sum deducted.

COSTS UPDATES TO CLIENTS IN FIXED RECOVERABLE COSTS CASES (2)

Although it is tedious, to put it mildly, my advice is to have template updates, with figures, for the movement between each stage in each band, but with 16 stages, and therefore 15 potential movements, and four Complexity Bands, that is 60 different templates!

In the near future, I will prepare an example of a matter moving from Stage 1 to Stage 3, as obviously that is the first movement any of you will have.

From Stage 4 onwards in the Intermediate Track, you will not have to give alternate scenarios based on it possibly being in one Complexity Band and possibly being in another, as by that stage the matter would have been assigned to a band.

I have mixed feelings about providing to clients, by way of costs updates, the entire fixed costs tables, which are in Practice Direction Table 12 for the Fast Track and Practice Direction 45 Table 14 for the Intermediate Track.

These are long and complicated to put it mildly.

If a full explanation is given to the client as to what is happening in their particular case, then I have no problem in attaching and referring to those tables, but on one very significant condition.

That condition is that it is made crystal clear to the client that those tables deal with recoverable costs and are not the costs that you as a solicitor will be charging to your client.

Many firms fell foul of this in the old Fixed Costs regime by, unwisely in my view, putting the tables in the Conditional Fee Agreements.

This gave clients the opportunity to challenge any success fee on the ground, not unreasonable in the circumstances, that they thought the maximum liability would be the figures set out in the Fixed Recoverable Costs tables.

Of course, if you are using the Fixed Recoverable Costs as the base of your own costs, for example, Fixed Recoverable Costs plus 50% being the solicitor and own client charge, then reference to the tables is useful.

Examples can be given, but then a statement made that the charge to the client will be 150% of the figure in the Fixed Recoverable Costs table.

FAST TRACK COSTS CAN BE 10 TIMES HIGHER THAN INTERMEDIATE TRACK!

Having tried dozens of different examples, it is clear that in many cases, both civil and personal injury, the fees are higher in the Fast Track as compared with the Intermediate Track for the same case.

This is for various reasons:

(i) The key stage of the Fast Track is issuing proceedings, where there is a sharp jump in fees, and indeed that has been the case for the last ten years;

(ii) In the Intermediate Track, that stage is the service of the Defence, which is obviously later;

(iii) The inflexible nature of the Fast Track as compared with the flexible nature of the Intermediate Track, which means there is certainty in the Fast Track as to the Band;

(iv) The very high percentage of damages calculation of fixed fees in Band 4 of the Fast Track — 48% including VAT.

This is so counter-intuitive, that I have several times gone back to the actual Rules to check it was not a mistake or a typo!

Let us ignore any issue of whether the court will agree to put into the Fast Track matters which on the face of it are financially in the Fast Track on one hand, or the Intermediate Track on another.

Thus, we have a straightforward Road Traffic Accident, and one case is worth £24,000 and is Fast Track and the other is £26,000 and thus is Intermediate Track, although of course it will probably be allocated to the Fast Track.

It is issued and settles before trial.

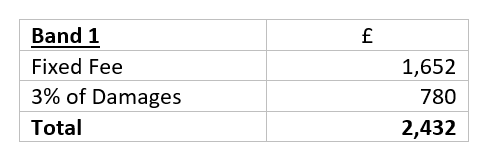

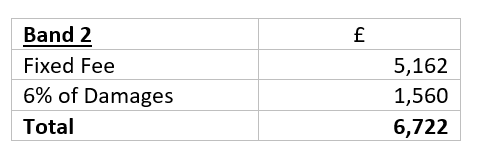

The Fast Track calculation is as follows:

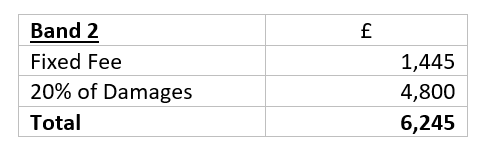

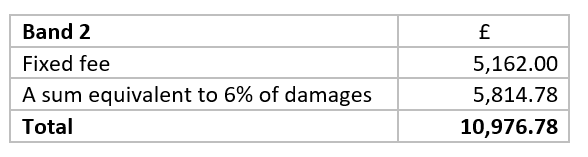

Intermediate Track – almost certainly Band 1

Even if it would be allocated to Band 2 in the Intermediate Track — very unlikely if it is settled before the Defence is served, then you hardly lose out as the calculation would be:

If that £26,000 claim was in the Fast Track, then the figures are as follows:

Thus, even if the matter was in Intermediate Band 2, you are only £77 better off in the Intermediate Track.

Because of the high percentage figure in the Fast Track, lawyers are better off in the Fast Track, the higher the damages!

Of course, if a Defence is served pushing the matter into Stage 3 of the Intermediate Track, then you rely on the value of any claim over £25,000 to seek to get it into the Intermediate Track.

In a personal injury case, I think it very hard indeed for a defendant who never receives costs, due to QOCS, to seek to argue that it should be in a higher track than that proposed by the claimant.

They may try to do so but yet again, that is highly counter-intuitive and may not find favour with the courts.

Let us look at the facts of a particular case brought to my attention.

The balance outstanding and recovered by the claimant was £96,913.

Let us assume that the matter is allocated to Band 1, 2,3 or 4 of the Intermediate Track and is resolved after proceedings have been issued, but before a Defence is served.

Fixed Recoverable costs are as follows:

Intermediate Track:

Even if the matter was at Band 2 one, the calculation is as follows:

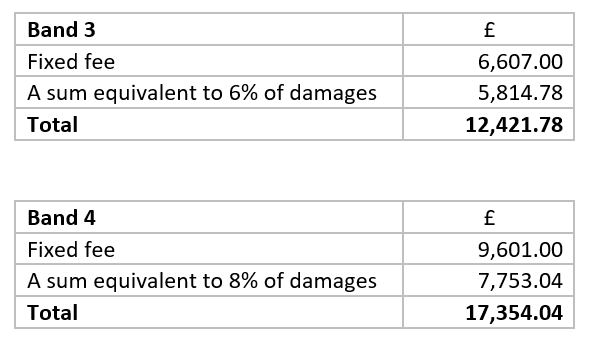

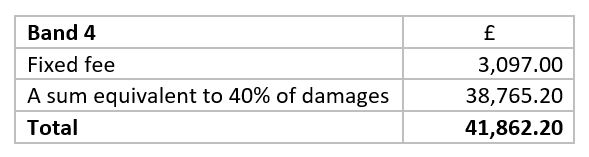

If the matter was assigned to Band 3, or Band 4 the calculations are as follows:

In Band 4 of the Fast Track the Fixed Recoverable Costs would be as follows:

All these figures have VAT on top.

This is bizarre, and presumably completely unintended, and arises from the very high percentage of damages in Band 4 of the Fast Track, 40% plus VAT, and as the damages do not have VAT on them, this equals 48% of damages.

Thus, depending on which band the matter went into in the Intermediate Track, and adding VAT, the minimum advantage in being in the Fast Track is £29,409.80, and the maximum is £44,821.96.

Thus, by being in the Fast Track, you will receive over twice as much as if the matter was in Band 4 of the Intermediate Track and very nearly 10 times as much if it is in Band 1 of the Intermediate Track!

FALSE FUNDAMENTAL DISHONESTY ALLEGATIONS: INSURERS SHOULD BE AT RISK OF IMPRISONMENT AS MUCH AS DISHONEST CLAIMANTS

In

Thakkar & Ors v Mican & Anor [2024] EWCA Civ 552 (20 May 2024)

the Court of Appeal considered one of the most controversial aspects of modern costs law in the field of personal injury, and that is the consequences, or lack of them, of a personal injury defendant, virtually always an insurance company, falsely and often dishonestly alleging fundamental dishonesty.

This stems from the system of Qualified One-Way Costs Shifting reintroduced in 2013 after a 482-year absence whereby unsuccessful claimants in personal injury matters do not have to pay the costs of the successful defendant.

That system was designed to give access to justice to personal injury claimants, following the abolition of the recoverability of After-the-Event insurance premiums and the virtually complete removal of legal aid for personal injury matters.

However, the Qualified One-Way Costs Shifting provisions are subject to various exceptions, one of which is contained in CPR 44.16(1) which reads:

“(1) Orders for costs made against the claimant may be enforced to the full extent of such orders with the permission of the court where the claim is found on the balance of probabilities to be fundamentally dishonest.”

Practice Direction 44, paragraph 12.4 dealing with this provision reads:

“12.4 In a case to which rule 44.16(1) applies (fundamentally dishonest claims) –

(a) the court will normally direct that issues arising out of an allegation that the claim is fundamentally dishonest be determined at the trial;

(b) where the proceedings have been settled, the court will not, save in exceptional circumstances, order that issues arising out of an allegation that the claim was fundamentally dishonest be determined in those proceedings;

(c) where the claimant has served a notice of discontinuance, the court may direct that issues arising out of an allegation that the claim was fundamentally dishonest be determined notwithstanding that the notice has not been set aside pursuant to rule 38.4;

(d) the court may, as it thinks fair and just, determine the costs attributable to the claim having been found to be fundamentally dishonest.”

In all cases subject to Qualified One-Way Costs Shifting, a costs order is made in the usual way, in favour of a successful defendant against an unsuccessful claimant but cannot be enforced unless one of the exceptions applies.

Thus, an allegation of fundamental dishonesty or the threat of such an allegation, can alter the dynamics of a personal injury claim from being one where the claimant is at no risk at all of paying anything out to one where the claimant risks financial ruin and bankruptcy.

There is a widespread perception that the system is being seriously abused by some defendant insurance companies and their solicitors; here the Trial Judge said:

“This is, in truth, an absolutely standard road traffic accident which, for reasons that slightly baffle me, this particular fee handler at DAC Beachcroft has decided to label as fundamentally dishonest.”

The Court of Appeal said that

“such allegations should only be raised if it was appropriate to do so, and in accordance with professional obligations of both counsel for the respondents [defendants] and his instructing solicitors”. (my bold)

Here, the Court of Appeal was considering whether there should be a costs penalty against the defendant who had made unwarranted allegations of fundamental dishonesty.

The Court of Appeal held that each case is fact specific and that there is no general principle that the defendant should be ordered to pay indemnity costs in such circumstances.

There was no default entitlement to indemnity costs in cases where the claimant is found to be fundamentally dishonest, although costs will often be ordered on the indemnity basis in such cases.

Here, the Court of Appeal found that the Trial Judge had acted within the reasonable bounds of her discretion in refusing to make an order for indemnity costs against the defendant who had made unwarranted allegations of fundamental dishonesty.

The Court of Appeal said that even if there were justified criticisms of the defendants’ conduct, there was no principle of law that the Trial Judge had failed to follow and apply.

Lord Justice Coulson here said that he would have ordered indemnity costs:

“Other judges (and I am one of them) might have reached a different view. But that is not the test. The trial judge plainly reached a conclusion that was open to her in all the circumstances. Her conclusion on costs was not perverse.”

The Lady Chief Justice, whilst agreeing with that finding said:

“… nothing that I say there is intended to detract in any way from this statement of the obvious: that, because the making of a dishonest claim will very often attract an indemnity costs order against a claimant, a failed allegation of dishonesty will very often lead to the making of an indemnity costs order against the defendant, on the simple basis that “what is sauce for the goose is sauce for the gander… A defendant who makes allegations of this kind therefore runs a very significant risk that, if the allegations fail, indemnity costs will be awarded against them.”

The Lady Chief Justice also said that an unnecessarily aggressive approach to litigation was unacceptable and that in this case, both sides had been

“too ready to throw unnecessary and serious allegations against each other”, and she added:

Potential costs incentives are not a good reason for making unwarranted allegations of misconduct, let alone dishonesty.

The unfortunate effect of the parties’ conduct was to increase not only aggravation to an independent witness but also costs on both sides.

Although technically consistent with one another, these quotes clearly send out a mixed message and really leaves the position no clearer in the sense that whilst it is clear that there is no default entitlement to, or presumption in favour of, indemnity costs for a claimant where a defendant has unsuccessfully suggested that the claimant is fundamentally dishonest, one of the Court of Appeal judges referred to a defendant who makes allegations of this kind running

“a very significant risk that, if the allegations fail, indemnity costs will be awarded against them”.

The law is now uncertain and unclear in many ways in this field.

This was a pre-1 October 2023 personal injury accident, and therefore, not covered by the new Fixed Recoverable Costs scheme, which has very different provisions, and in particular, it would have been helpful if the Court of Appeal had given guidance, which would have been obiter, on whether such conduct by a defendant would amount to unreasonable conduct under the new law, with a mandatory 50% increase in the claimant’s Fixed Recoverable Costs.

Unfortunately, it looks as though we are going to be in the same position as when the original Fixed Recoverable Costs scheme came in on 1 April 2013, which is that we will have to wait years for guidance from the senior courts.

This was a major lost opportunity for an early clarification of the law of unreasonable conduct in civil litigation valued at £100,000 or less.

In most cases, indemnity costs have been abolished and replaced in Part 36 cases by a 35% uplift and in unreasonable conduct cases, by a 50% uplift, or reduction, in costs.

Not only are the financial awards and penalties different, but so are the principles.

In this case, the Court of Appeal said that it was “properly conceded” at the appeal by the claimant that up to the point where fundamental dishonesty was alleged, there should only be standard costs and there should be no consideration of indemnity costs for that pre-allegation period.

That has completely changed, following the 1 October 2023 amendments, as misconduct by a party means a 50% uplift or penalty on the whole of the costs, and not just from a certain date or in relation to certain aspects of the proceedings.

Here, in considering the issue of indemnity costs, the Court of Appeal referred to no fewer than 14 cases relating to a system which has largely been abolished but gave no guidance in relation to the new law.

Ironically, in this case, one of the reasons why the Court of Appeal refused to overturn the decision was that the Trial Judge had always regarded the raising of the dishonesty allegations as “a storm in a teacup” and did not think that this was a case where those allegations would or did make any real difference to the outcome.

Thus, the very triviality and unreasonableness of the defendants’ behaviour in this matter potentially got them off the hook, whereas under the new law that would make it much more likely that the court would find unreasonable conduct and impose the mandatory 50% costs uplift for the whole case.

That represents a total failure by the Court of Appeal, and indeed all the judges in this matter, to understand the devastating effect that such an allegation, however apparently trivial or unreasonable, has on a claimant in a personal injury action.

A finding of fundamental dishonesty against a claimant now frequently leads to the insurance company considering the question of contempt of court and making an application for such a dishonest claimant to be imprisoned.

I have no problem with that, but why should a defendant falsely alleging fundamental dishonesty not run the risk of committal to prison?

Employing the term used here by the Court of Appeal what is sauce for the goose is sauce for the gander.

Where a defendant, usually a rich and powerful insurance company, makes a false allegation of fundamental dishonesty, then in my view, the court should always, but always, consider a finding of contempt of court, and where appropriate, the conduct of the barristers and solicitors involved should be examined, just as it effectively is when a claimant is found to be fundamentally dishonest.

There should be an automatic penalty on a defendant who has been found by the court to have falsely alleged fundamental dishonesty.

I propose that there be an automatic doubling of damages in such cases, to compensate the claimant for the anguish that they have suffered, and to deter defendants from wrongly raising such allegations.

That, coupled with the automatic 50% uplift in Fixed Recoverable Costs under the new Fixed Recoverable Costs regime should be enough to sort this issue out.

I reported the facts of this case in my piece – NO PRESUMPTION IN FAVOUR OF INDEMNITY COSTS FOR CLAIMANT WHERE DEFENDANT UNSUCCESSFULLY ALLEGES CLAIM IS FUNDAMENTALLY DISHONEST.

For the sake of completeness, I set out that article here.

NO PRESUMPTION IN FAVOUR OF INDEMNITY COSTS FOR CLAIMANT WHERE DEFENDANT UNSUCCESSFULLY ALLEGES CLAIM IS FUNDAMENTALLY DISHONEST

I will be writing a much more detailed piece on this whole subject.

In

Thakkar & Ors v Mican & Anor [2024] EWCA Civ 552 (20 May 2024)

the Court of Appeal has confirmed that there is no default entitlement to, or presumption in favour of, indemnity costs for a claimant where a defendant has unsuccessfully suggested that the claim is fundamentally dishonest.

While there are some first instance authorities that have considered the effect on costs of unsuccessful allegations of dishonesty, there was little if any prior authority on this point where Qualified One-Way Costs Shifting applies, and the court is considering the liability of a defendant responsible for alleging fundamental dishonesty unsuccessfully.

Following a successful Road Traffic Accident claim, the claimants were appealing against a High Court decision to uphold the Trial Judge’s decision refusing to make an order for indemnity costs against the losing defendants.

The claimants’ grounds of appeal included that in Commercial and Chancery cases, the failure of allegations of fundamental dishonesty attracts a presumption that indemnity costs will be awarded, which effectively reverses the burden of proof, such that the paying party must demonstrate why indemnity costs are not payable, and this approach should apply in personal injury cases.

The defendants had stated that the claimants’ honesty would be challenged at trial.

Permission to amend their defence to allege fundamental dishonesty was refused, but it was understood that the defendants were not prevented from raising these allegations at trial.

As this was a personal injury claim, the QOCS regime applied unless the defendants could show that the exceptions in CPR 44.15 – claimant’s conduct likely to obstruct just disposal of proceedings, or in CPR 44.16 – claim is fundamentally dishonest, applied.

The Court of Appeal held unanimously that there was no presumption or starting point in favour of indemnity costs, or reversal of the burden of proof, where allegations of fundamental dishonesty have been rejected.

It will always depend on the circumstances of the case, and the judge retains a complete and unfettered discretion.

The Court acknowledged that, given that making a dishonest claim will very often attract indemnity costs against a claimant, a failed allegation of dishonesty will also very often attract indemnity costs against the defendant.

However, the ultimate decision is for the trial judge, based on all the circumstances of the case.

The Court also rejected the other grounds of appeal: the Trial Judge did not apply the wrong test or fail to give adequate reasons, nor was her judgment on costs perverse.

Accordingly, the appeal was dismissed.

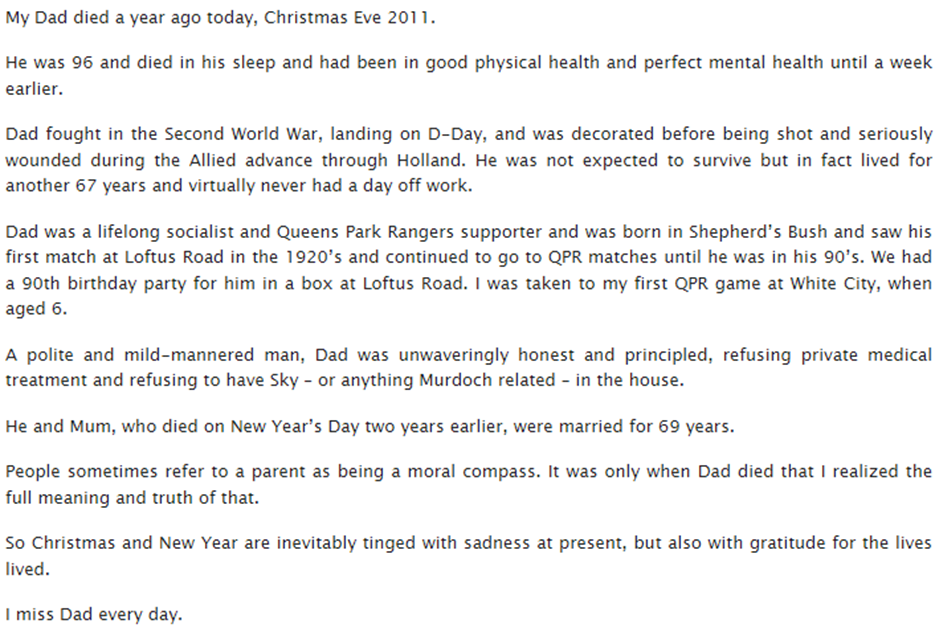

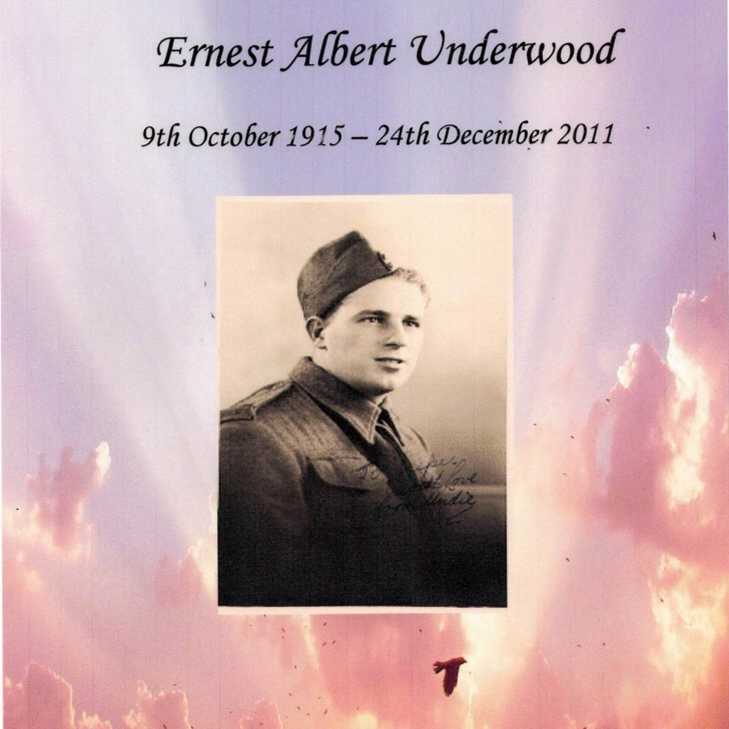

D-DAY: 6 JUNE 1944: MY DAD

I set out below a piece that I wrote on Christmas Eve, 2012, the first anniversary of my Dad’s death.

My Dad landed on D-Day and as with most of those who liberated Europe, almost never spoke about D-Day and the fighting in the war as compared with his view, not always charitable, of officers etc.

As Dad got older, and D-Day became part of history teaching, he was invited to speak at schools and so on about his experience and he did then talk much more about what happened.

This was not a quick hop on a cross channel ferry, but a crossing that took up to 24 hours, and in some cases, 36 hours.

It is hard to imagine the fear of those Allied soldiers during that period.

My two biggest heroes, by a million miles, are my Dad and Nelson Mandela.

Here are three quotes from Madiba.

I learned that courage was not the absence of fear, but the triumph over it. The brave man is not he who does not feel afraid, but he who conquers that fear.

It always seems impossible until it’s done.

Death is something inevitable. When a man has done what he considers to be his duty to his people and his country, he can rest in peace.

MY DAD

80TH ANNIVERSARY OF D-DAY LANDINGS: THURSDAY, 6 JUNE

Here is the programme for Bovingdon Green, Hertfordshire, this Thursday, 6 June for the 80th Anniversary of the D-Day Landings; my Dad landed on D-Day.

Everyone is welcome and please email me on kerry.underwood@lawabroad.co.uk if you need any further information.

Thursday, 6 June:

17.00 Cricket club open

17.30 Cricket Club bar open. Kerry Underwood hosting during evening.

17.30 Fish and Chips available to buy. It’s National Fish and Chip Day.

17.30/18.00 Waddingtons on the Road coffee vendor in situ

17.30-18.00 onwards – Scouts – Burgers etc

18.00 Cricket Match. Bovingdon Mid-Week team v The Grove

20.45 Cricket match ends

21.00-21.10 Assemble at Beacon Brazier

21.14/15 Mark Jarrad to read D-Day Poem

21.15 Richard Roberts lights the beacon

21.30/22.30 – Cricket Club bar remains open.